Experienced traders confirm that in the beginning you will sometimes win, sometimes lose. But the point is that the money is always in your hands. You just have to find a way to make your victory happen.

What you need to do is try different strategies and save them. And after a process, you can continue to research methods that work and eliminate those that don’t.

And then the time will come when you will realize things are changing for the better. Your trade will be successful whenever you completely do the 4 things below. If you can’t meet at least one thing, you will fail.

First, treat the demo account like a real account

The big advantage that the demo account brings is that you will not lose your money. That means you can practice as much as you want without depositing money.

That’s why you should practice a lot of strategies on a Demo account. You should try the strategy patterns more than once until you meet your desired results. And then, use the real account.

Not only that, we will try out different financial instruments, different order levels and different time frames, etc. Until all are profitable, it’s time to use a real account.

But be careful, many traders use demo accounts as entertainment. They work hard to use large amounts of money, not hesitate to use all strategies at the same time. This gives them the mentality of not being serious in any choice. And will definitely waste you money in the future.

The best way is to treat demo accounts as your own savings accounts, use them wisely, confidently. This will help you remember and clearly distinguish bad and good moves, thereby gradually accumulating real combat experience.

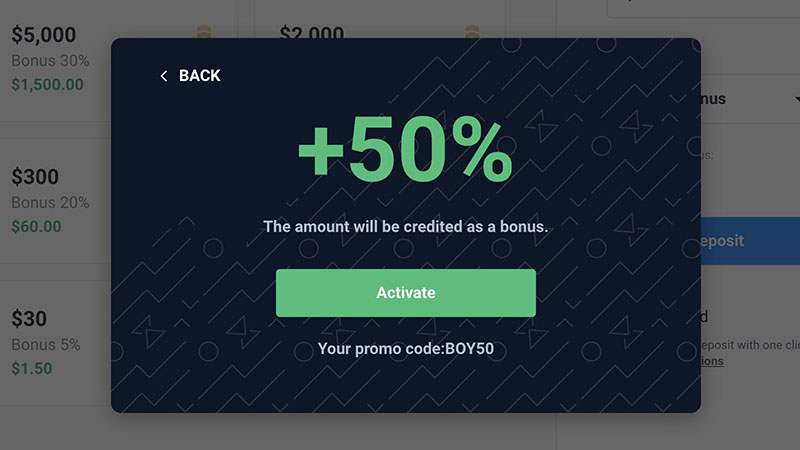

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Say no to short transactions

With Fixed Time Trade, you will definitely be intrigued by earning 82% within 1 minute. But that is the problem in itself, 60 seconds is not enough for any strategy to work.

You won’t learn anything from your 60 second trading failures. And when successful, they become a trap when you see you can easily make big money in a short time. Day by day you will put more and more money into a trade and this is called the Fibonacci rule, you will bet more until you lose a single trade with all your money.

Prices are always volatile in the short term and are unpredictable, so avoid short-term trades as much as possible.

Check transaction history regularly

The common rule of all investors is to minimize losses and maximize winnings. Through reviewing past trades and drawing lessons will bring you unimaginable benefits in terms of knowledge.

The secret of seasoned investors is that they always have a handwritten trading diary. They will always check profitable trades and losing trades.

But that’s the story of the old days, it’s good that OlympTrade offers you a history review tool, called “Trading”. You can review your entire transaction history stored and completely secure.

What have you learned from successful and failed trades? Time, asset class, market volatility, global financial news? For example you can spot the most liquid EUR/USD from 10am to 11am. And so you know that it’s best to trade at this point.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Stick to the plan

Every newbie trader executes the same kind of plan, tries trades, takes notes, swaps asset pairs and repeats. This is not very effective, perhaps by the time you realize it, you have already lost more than 80% of your trading assets.

Make a more detailed plan that includes the following:

- Spend time on Demo account. You need a few weeks to test it out before trying to trade a new asset. Later, once you have mastered the rules of many currencies, you can completely trade sequentially between Demo and real accounts, one to make money, and one to practice.

- Record important transactions, and capture the factors that influence. This greatly affects your trading psychology, helping you think and analyze more carefully, remember longer. Take detailed notes in which time, strategy, indicators, tools, trading timeframes are required.

- How much for trading? The amount you will use, the amount to invest for a trade, stop loss, time frame, chart, indicator, market, trade time, stop time (3 losing trades) consecutive losses), the time to withdraw the profit and the percentage of the balance to be withdrawn.

This is just a basic example of a trading plan, in fact you should find for yourself the one that best suits your trading style, and above all make sure to stick to your plan.

So how long have you been trading on OlympTrade and what are your results?