In financial transactions, in addition to typical factors such as emotions and assertiveness, the market factor is an important factor that investors need to clearly identify. Once the key factors of the market are known, the investor will have the opportunity to obtain optimal profits through the right trading options.

The ADX indicator in securities is one of the effective tools to help investors improve the accuracy of trading orders.

So what exactly is the ADX indicator? What method should investors use to effectively apply the ADX index in stock trading?

The following article will focus on explaining and instructing how to use the ADX indicator:

What is the ADX indicator?

The ADX (Average Directional Index) indicator was born from the invention of Welles Wilder in 1987. This indicator is represented on the chart with the symbols DI- and DI+.

The ADX indicator helps investors measure the strength of the current trend. The ADX indicator is useful to distinguish the conditions of a clearly trending market from a market with limited ranges.

ADX indicator in stocks

The ADX indicator helps trend traders to identify strong trends, thereby opening appropriate trading positions for them.

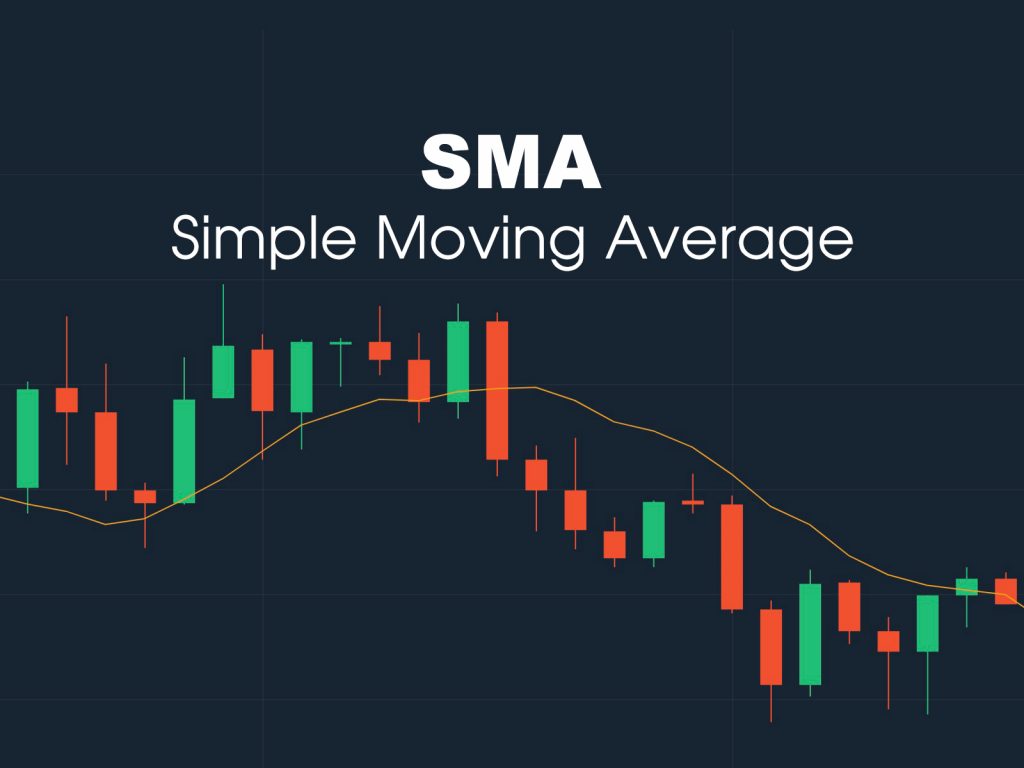

The calculation of the ADX index is based on the formula of the moving average of the volatility over a specific time period. That way you can determine if a stock is trending.

When the indicator is below 25 which is the market phase in a sideways trend, then the ADX can be used to pre-determine a breakout of a stable price zone. When ADX has risen above 25, the force is strong enough for the trend to start.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

ADX indicator components

The chart depicting the ADX indicator consists of 3 lines:

The ADX line, represented in dark blue, is calculated over 14 trading sessions.

The -DI line is indicated in red

The +DI line is shown in blue

In which, the ADX line will signal whether a new trend is established or not. And the -DI and +DI lines will help determine the buying and selling forces that exist in the market.

If the +DI line is above the -DI line, it is a signal that the market is in an uptrend. If the -DI line is above the +DI line, it is a signal that the market is in a downtrend.

Basically:

- When the ADX is between 25 and 50, it shows a strong trend.

- When the ADX is between 50 and 75, it shows a very strong trend.

- When the ADX is between 75 and 100, it shows a super strong trend.

Investors can rely on that to determine if a stock is in the overbought or oversold zone.

Using the ADX indicator in trend identification

- If the ADX index is between 0-25, the market is either trending out or trending weak, usually during this period the stock is trending sideways.

- If the ADX is between 25-30, the market is starting a new trend and that trend is getting stronger.

If the ADX is between 50-75, the market is in a strong price trend. - If the ADX is between 75-100, the market is in a super strong trend but this is very rare.

How to identify trends with the advanced ADX indicator - If the +DI line crosses above the -DI line and the ADX line crosses 25, it is a good signal to enter a buy order, and the stronger the ADX index increases, the clearer the trend.

- If the -DI line crosses above the +DI line and the ADX line crosses the 25 level, it is a signal for a downtrend, and the stronger the ADX index increases, the more obvious the downtrend will be.

- When the distance between +DI and -DI is larger, it is a signal for the appearance of a trend reversal.

Thus, all the necessary knowledge about the ADX index in securities has been synthesized by us through the above article. Hopefully, through the article, investors have understood the concept of ADX indicator, its meaning and calculation, especially how to use the ADX indicator effectively. Besides, investors need to research and combine other indicators and technical tools to optimize their investment efficiency. Good luck to the investors.