Although Kagi charts are less well known than the generally accepted chart types, they filter out market noise and make it easier for traders to understand price movements. In addition, it points to a potentially lucrative market entry that effectively acts as a trading signal generator.

Kagi Indicator Usefulness

Kagi charts are sensitive to trends. It is commonly used to show price movement. In this sense, it mainly resembles a Japanese candlestick, Area, Heiken Ashi or bar.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

The special feature of Kagi is that it does not have a time axis because it is not just focus on a periods. Instead, it reflects a change in price dynamics relative to past performance.

Typical chart types will show you a new candlestick for each season you choose. But it doesn’t show how all the candlesticks presented fit together if at all or how they fall on trend at all.

Identifying trends and profits is part of reading charts and guiding your trading decisions, which is explained by you when it comes to popular chart types. Many marketers find this process cumbersome and time consuming. Therefore, they look for alternative indicators to better understand price performance.

However, the Kagi board makes things easier.

Instead focus on the time, Kagi charts are sensitive to trends. It shows influential price movements related to past price growth. That way, it’s easy to show you the price action that you need to understand with other types of regular tables. It saves time and energy and gives you a better understanding of price movements.

Examples of Kagi Chart Reading

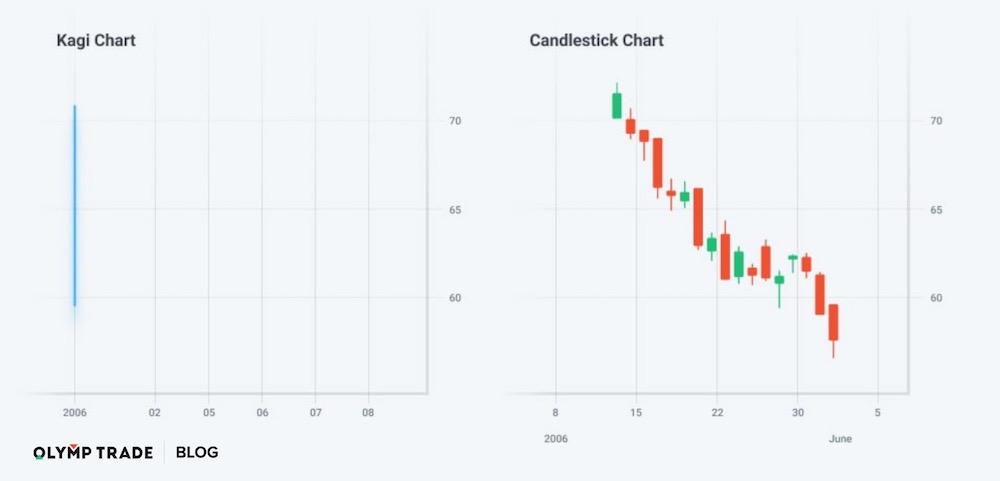

One Vertical Line, No Change

As shown in the figure, it is just a vertical downward. This line will be extended downward every time the price closes lower than the previous close.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

For example, instead of having three consecutive bearish candles on the right, you will see the down vertical being extended three times on the left.

Two Key Inputs, Three Scenarios

The timeframe on which the Kagi mechanism checks the price behavior each time is the input you set when configuring the Kagi chart. In this sense, it is similar to timeframes with popular chart types.

If the price reverses, the Kagi mechanism checks to see if it closed more than a certain percentage of the previous period’s closing price. This percentage is another important input to the Kagi chart.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Therefore, if the inversion is more than that percentage, you will have a new vertical line connected to the previous line by a horizontal branch. If it is smaller, the line remains unchanged.

Three scene of Kagi chart:

- The vertical gets extended each time the price moves in the same direction and surpasses the preset percentage.

- The vertical line stays unchanged if the new period’s price moves in or against the previous one below the preset percentage.

- A new vertical line gets formed if the price reverses and closes more than the preset percentage against the previous period’s direction.

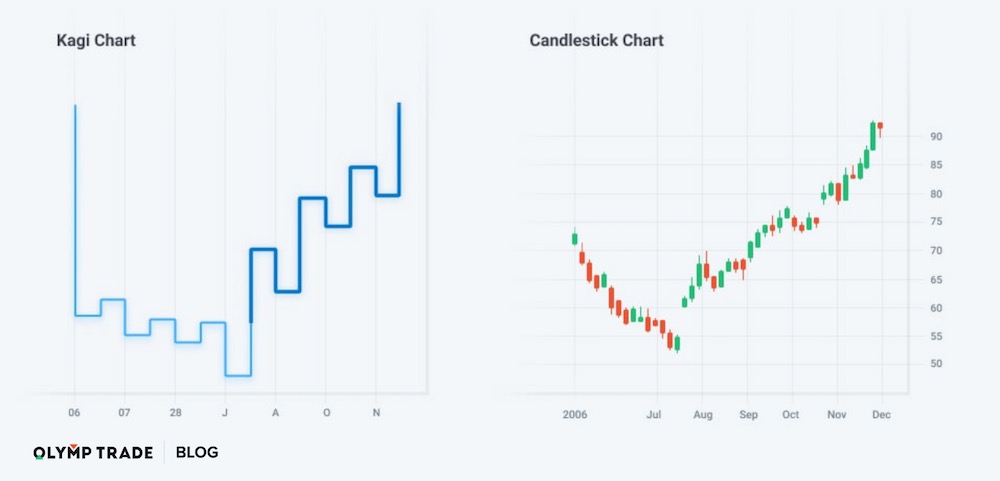

New Vertical Line

On the right candlestick chart, the last bullish candle closed more than the required percentage higher than the close of the previous candle. On the left Kagi chart, it is reflected by a new vertical line. This is how the Kagi chart shows a trend reversal.

Trend Reversals

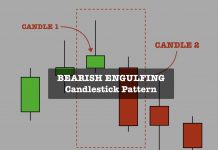

Large trend changes may be reflected on the Kagi chart by a different thickness of the line.

A variation of Kagi charts uses colors instead of line thickness to indicate trend reversals. Whenever there is a change in the line thickness, there is a trend reversal. Such a point is normally taken as a favorable market entry signal.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

In the picture below, you can see downward trends in red and upward trends in green. Correspondingly, the color-changing points are the suggested market entry signals.

The Best Way to Approach the Market

The Kagi chart is an unconventional tool, but we have learned that it can help traders better understand the price dynamics of trading instruments or, at the very least, provide an interesting alternative to the common chart types.

Ultimately, the best way to approach the market is to combine various charts and trading strategies while finding those that serve you best. In the meantime, expanding your knowledge about technical analysis tools and the market is always a worthy time investment.

Olymp Trade’s aim is to create a productive learning environment that helps you reach all your goals. The Kagi chart is just one of the many tools to learn about, and the Olymp Trade blog is happy to provide you with comprehensive knowledge about them.

You can find a large array of educational materials in the Help section located on the Olymp Trade platform as well.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.