The Bearish Engulfing candlestick pattern is one of the most common patterns at the end of an uptrend. In other words, this is a bearish reversal or peak pattern with the shape of a bear claw. Suitable for Traders who like to open bearish FTT trades or find a reasonable selling time.

Before to go, I think you should read this short article about the candlestick shapes: https://traderrr.com/name-of-shapes-of-japanese-candlestick-define-and-use/

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

What is the Bearish Engulfing candlestick pattern?

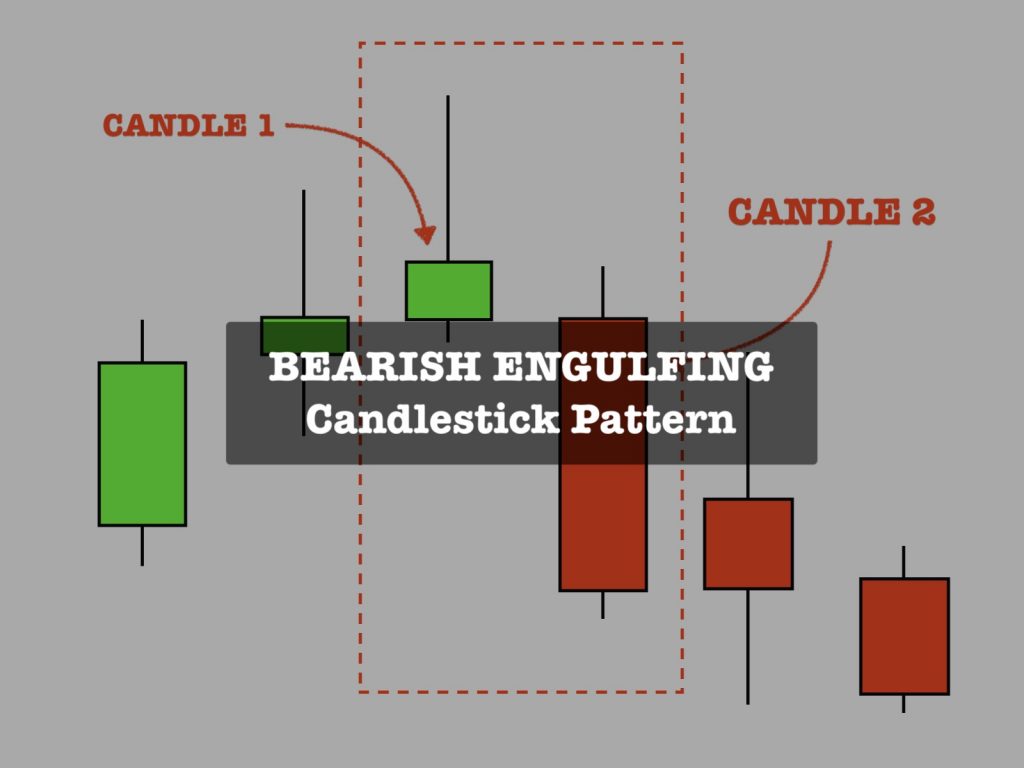

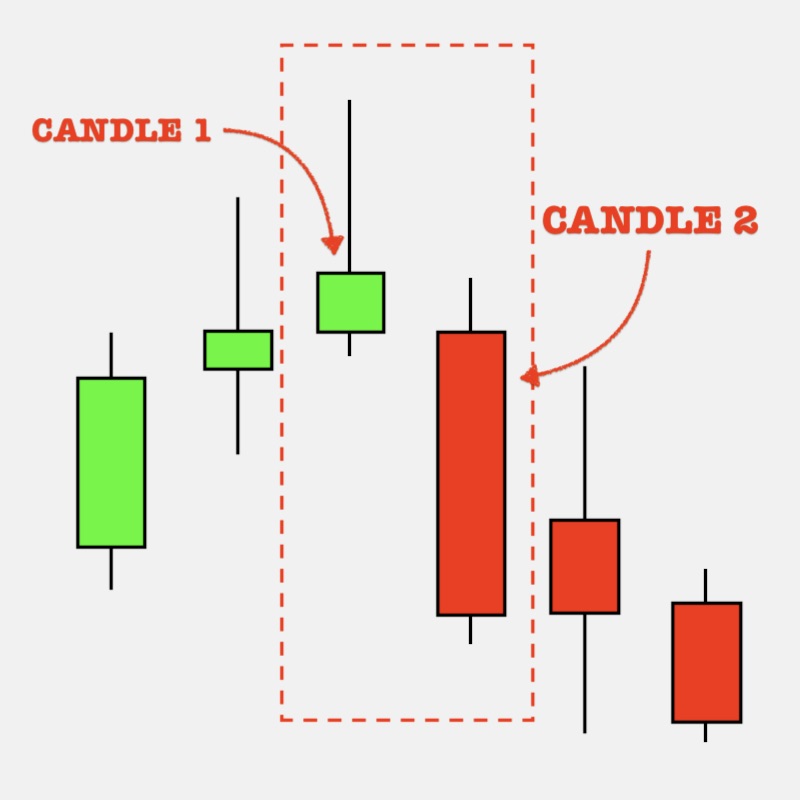

The Bearish Engulfing candlestick pattern usually appears at the end of an uptrend, it consists of only two opposite candles.

- Candle 1 is a bullish candle with a short body at the bottom with a long upper tail. That shows the market is having a strong pulling-about to the downside.

- Candle 2 is a complete bearish candle with a body 2 times longer than the body of candle 1.

- Remember that the chart should be a steady uptrend.

Meaning of Bearish Engulfing

Bearish Engulfing is a regular candlestick pattern found at the end of an uptrend. However, you can not define it without their characteristic that a weak bullish candle has a long upper beard, followed by an extremely strong bearish candle which is a sign of an imbalance of tension. It is a sign that the market starts to strongly reverse into a complete downtrend.

Remember, this is a pattern that makes sense if and only if the market is on the uptrend. The more steadily the price increases over a long period of time, the more likely the reversal point of this pattern appears. The probability is relatively large.

How to open a Bearish Engulfing trade

The Bearish Engulfing candlestick pattern is easy to enter. If you are on the verge of an uptrend and see a Bearish Engulfing candlestick pattern, now is the time to take profit or open a bearish position.

The best time to focus your attention is when the candle 1 appears. It’s best if you try to make a short position.