![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

Continuation Pattern

Continuation Pattern is the common name for patterns that predict prices will continue to follow the current trend if a pattern appears.

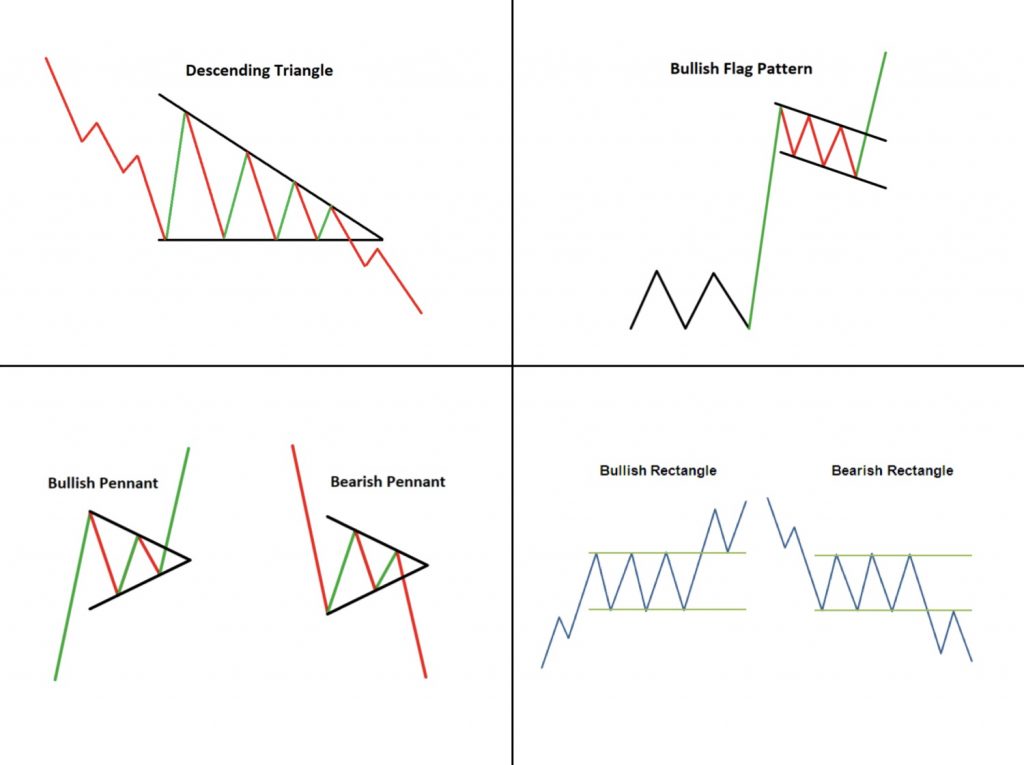

Patterns commonly used are the Triangle Pattern, the Flag Pattern, the Pennant Pattern, and the Rectangle Chart Pattern.

Meaning

The trend continues after the breakpoint

The name indicates that the price trend is likely to resume the trend after the pattern is completed. However, prices can still reverse after the appearance of Continuation Patterns, although the possibility is not high.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

The pattern continues to be very effective when it was previously a strong trend, which was just a break in the middle trend. For example, that is a good signal if the price is on a very good uptrend and forming a small flag pattern, then the price quickly breaks the overhead resistance and continues upside down.

https://traderrr.com/breakout-support-and-resistance-entry-position-on-fixed-time-trade/

Trend reversed

However, if the pattern appears to be the same size as some previous oscillations, this indicates that the price range is increasing. The trend will no longer be clear, become unstable, and there will be signs of a reversal from the current trend.

When a trend is not clear

If the growing trend is weak but the continuation pattern appears repeatedly, it is not convincing enough to use these patterns signal. They are only effective on a strong and obvious trend.

A strong trend shows that the price is strongly dependent on one side of sell/buy, and it is not easy to break the trend. This means that if a spike occurs and the price reverses, it is easy to see.

![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.