Reading price charts and making trading decisions is the essence of market technical analysis. Mostly it is based on a set of a few simple patterns. Observing them in combination on various timeframes, traders can achieve a higher probability of accurate price direction forecasts.

This article covers the most commonly used chart patterns and shares some tips on how to best do that.

Pick a Chart Type

The Olymp Trade trading platform offers various chart types. Among them, Japanese candlesticks are the easiest to read and reflect 90% of the market price dynamics. That’s why we recommend using this chart type for trading unless you are familiar with other chart types. For this reason, we will be reviewing the patterns that can be applied to the Japanese candlestick chart.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Best Time Frame to use

Major timeframe signals in trading are generally considered more reliable. That is not to say that they are more often true in the long run than in the short term. Instead, it reflects the fact that long-term patterns allow more time for thorough testing, which leads to a higher chance of an accurate forecast.

However, the relatively better reliability of large timeframe patterns does not mean that you only have to use 4h or 1d. Instead, use a combination of time frames to cross-check your sample observations. For example, for long term strategies we will use the 4h, 1d and 7d timeframes which can make a good set. Meanwhile, 30 minutes, 1 hour and 4 hours would be good for midterms. For short-term trading, the 1-hour and smaller timeframes combined can provide a good market perspective.

Technical Analysis Chart Patterns

Trend Reversal Patterns

Trend reversals may be good moments to enter the market. People say:

“Identifying a coming trend reversal is key to technical analysis”.

Hence, the most widely known trend reversal chart patterns. Here are some of the most popular:

Pin Bar (Reversal in Any Direction)

A short candle with a long shadow appears after a long opposite trend.

Don’t care about the color of the lampstand that doesn’t matter. Whether it is red or green, it usually foreshadows a trend reversal and can be taken as a signal for that.

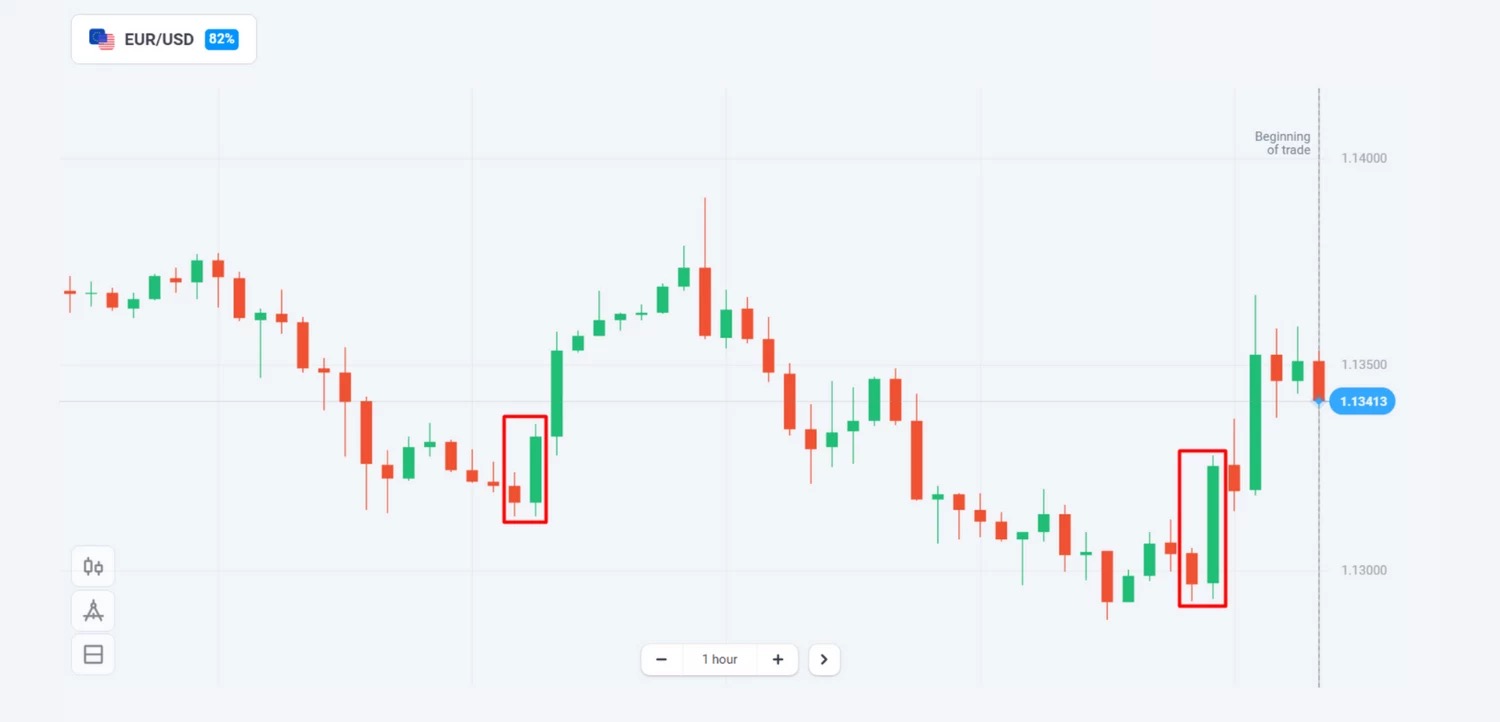

Piercing Cloud (Upward Reversal)

A short red candle is followed by a larger green one that has a slightly lower low and a notably higher high.

Dark Cloud Cover (Downward Reversal)

A short red candle after a larger green one that has a slightly higher high and low.

Once the second candle is formed, prepare for a downtrend.

Bullish Engulfing (Upward Reversal)

After a downtrend or a series of red candles, a green candle appears with its body length covering the previous candle’s body.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

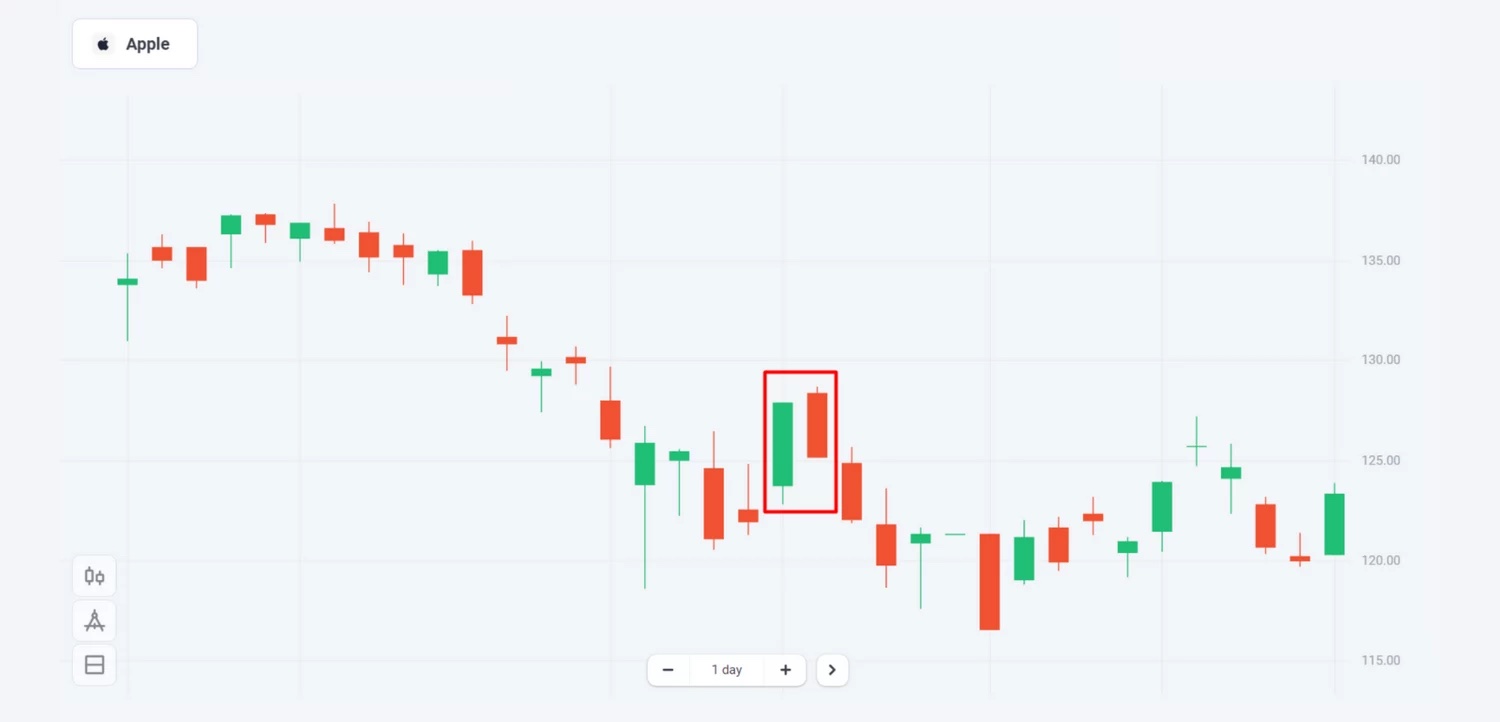

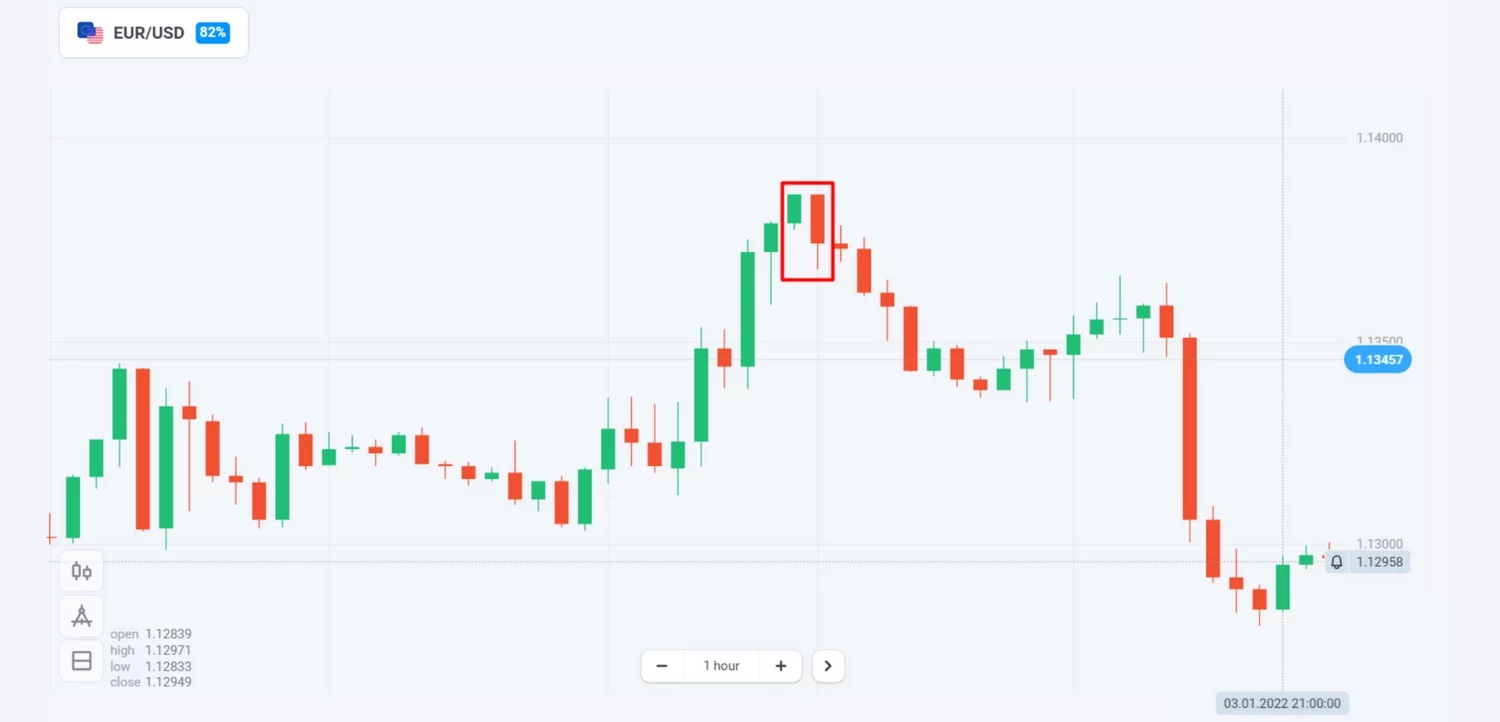

Bearish Engulfing (Downward Reversal)

After an uptrend or a series of green candles, a red candle appears with its body length covering the previous candle’s body.

This chart formation often foreshadows downtrends.

Head and Shoulders (Downward Reversal)

- The left shoulder is formed by an upswing followed by an equal drop.

- The head is formed by a long-term uptrend that peaks notably higher than the left shoulder and is followed by a full reversal down to the base level.

- The right shoulder is formed by another uptrend that starts at the base of the head and is followed by an equal drop.

As this chart pattern often precedes downward reversals, prepare to sell.

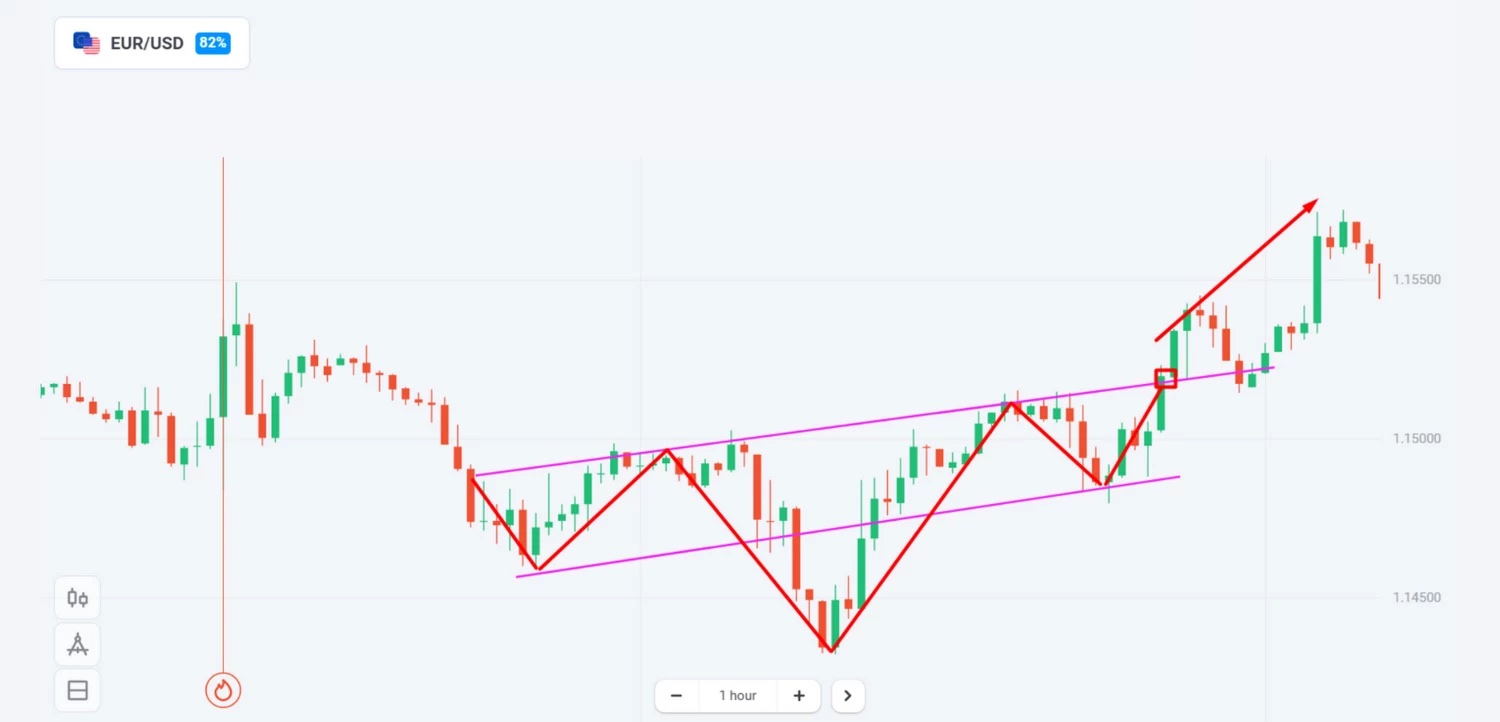

Inverted Head and Shoulders (Upward Reversal)

- The left shoulder is formed by a downswing followed by an equal rise.

- The head is formed by a long-term downtrend that dives notably lower than the left shoulder and is followed by a full reversal up to the base level.

- The right shoulder is formed by another downtrend that starts at the base of the head and is followed by an equal rise.

This pattern is frequently observed before upward reversals. Once you see it, prepare to buy.

Triple Bottom (Upward Reversal)

The price gets deflected by the resistance level twice, forming three bottoms at approximately the same level. After the price breaks the resistance level, a new uptrend is formed.

The recommendation here is to buy after the price breaks the resistance.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

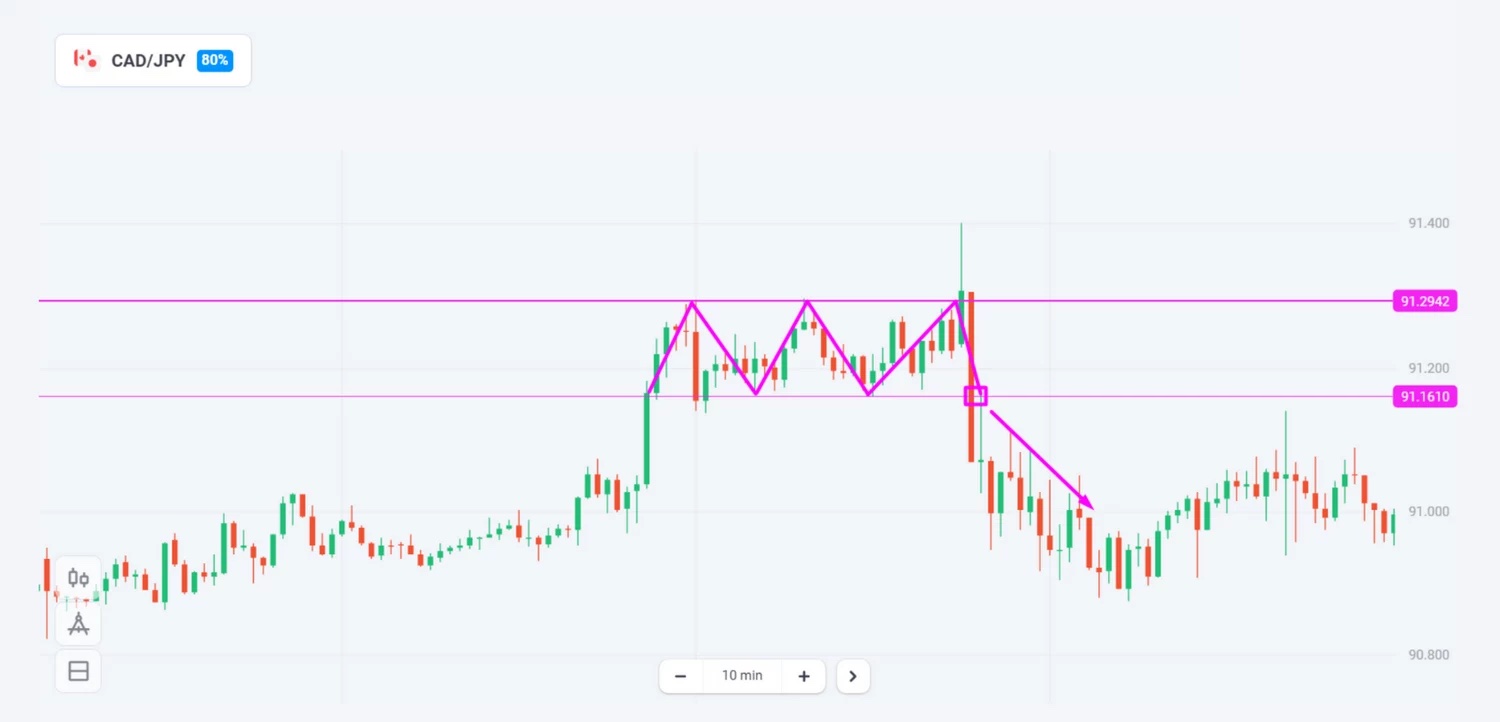

Triple Top (Downward Reversal)

The price bounces from the support level twice, forming three tops at approximately the same level. After the price breaks the support level, a new downtrend is formed.

With this chart pattern, it is best to sell after the support is broken.

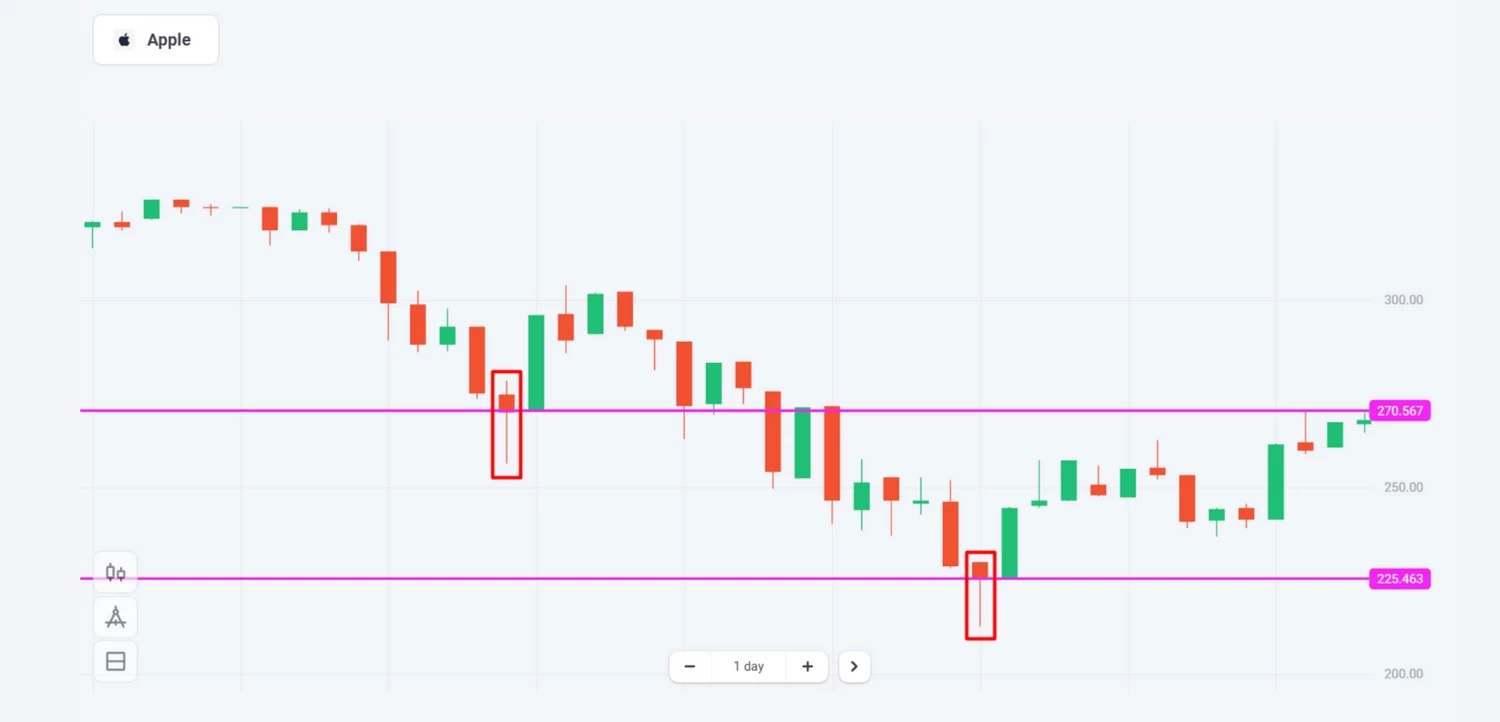

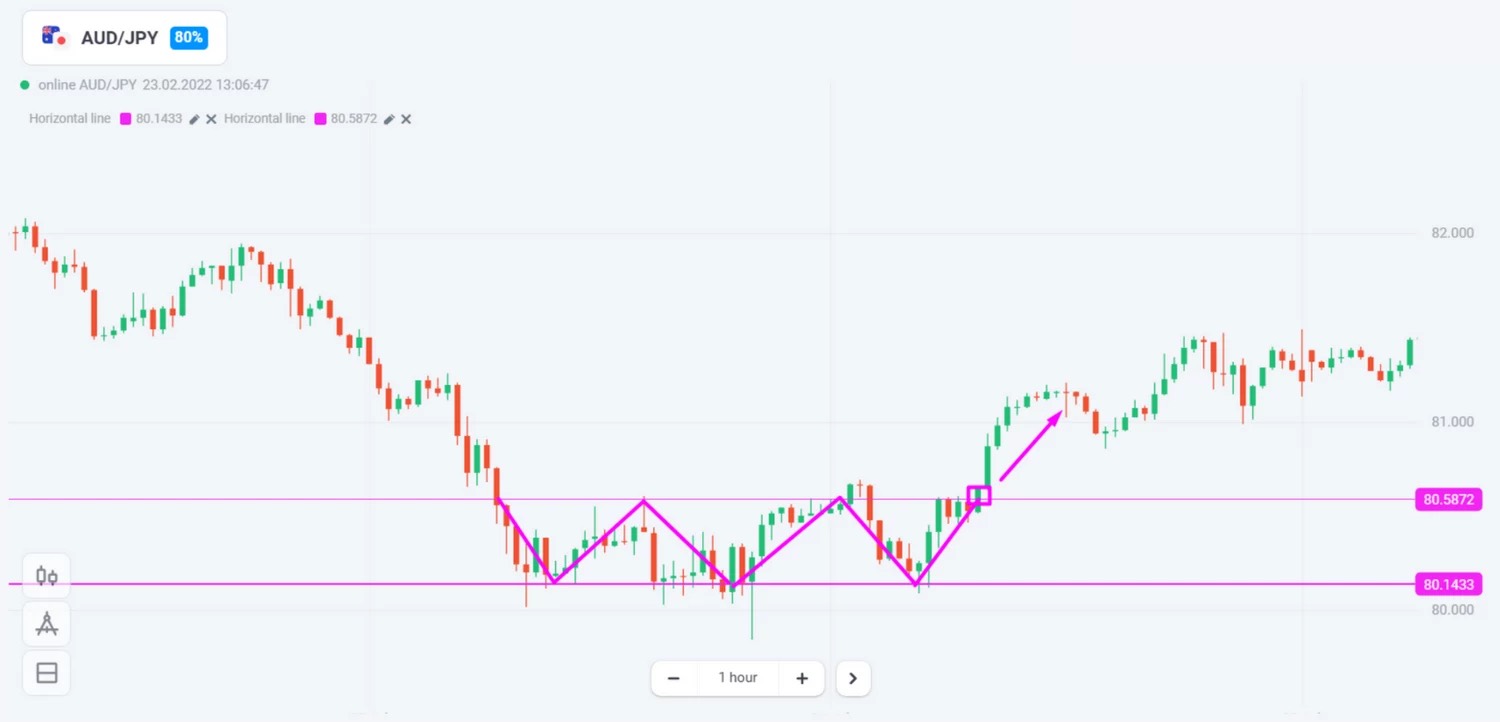

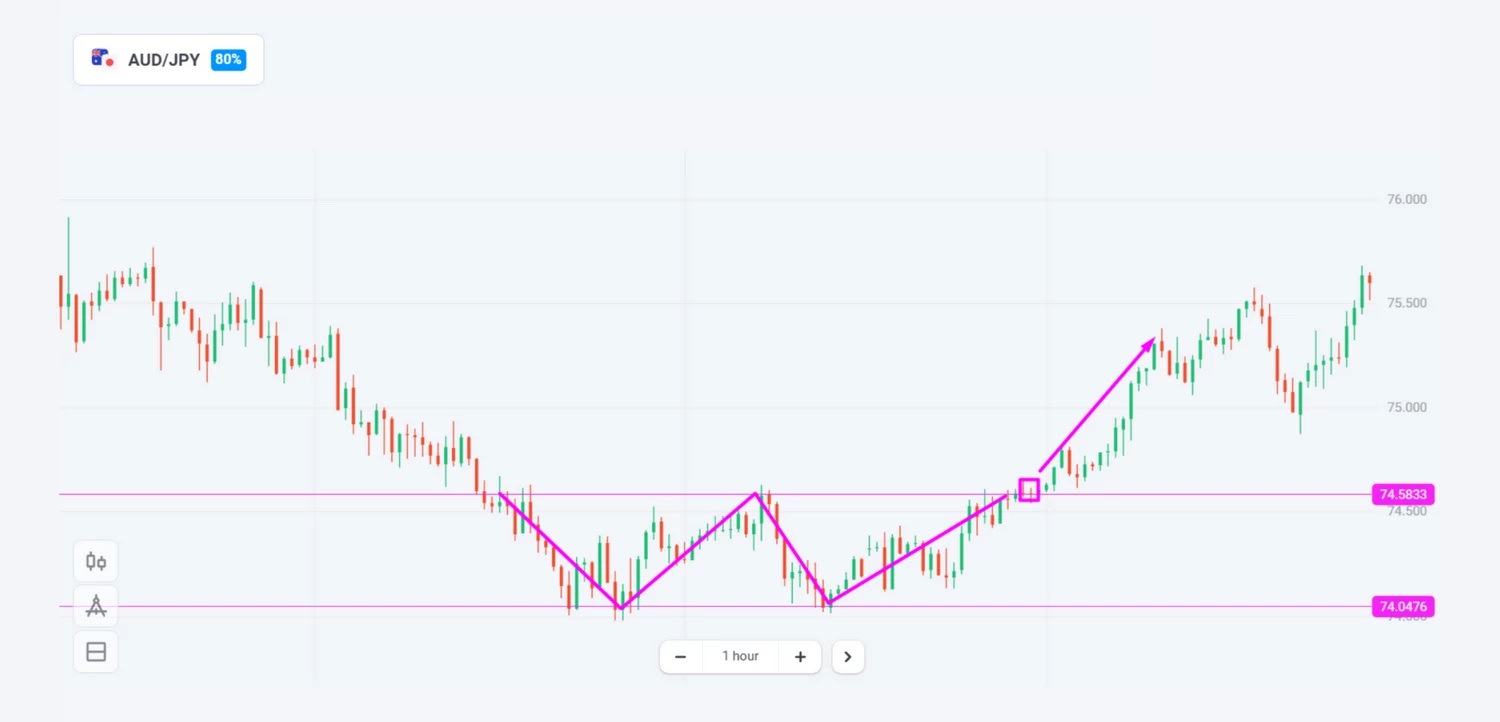

Double Bottom (Upward Reversal)

The price makes a W-shape formation as it tries to break the resistance level. Once it does, a new uptrend is formed.

This chart pattern works similarly to the Triple Bottom.

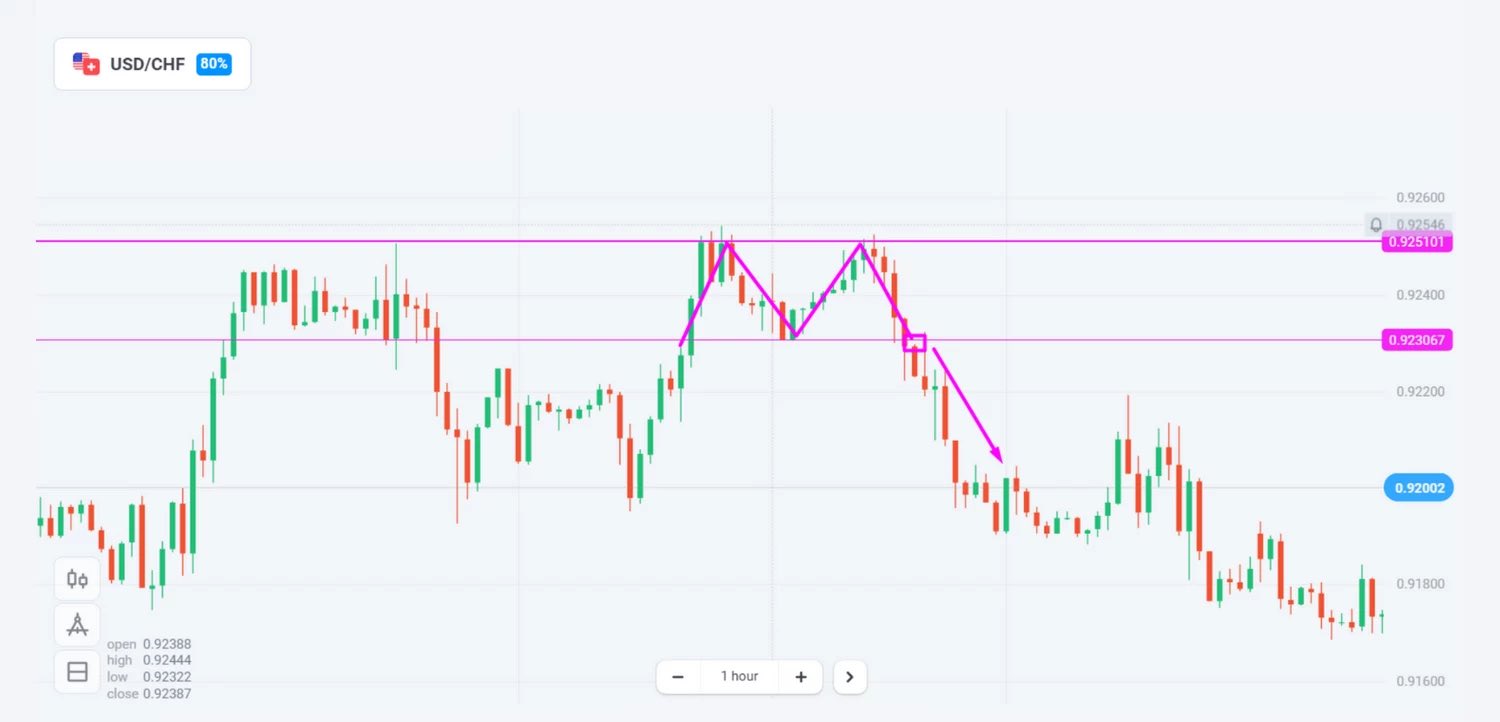

Double Top (Downward Reversal)

The price makes an inverted W shaped formation as it tries to break the support level. Once it does, a new downtrend is formed.

The best way to act on this pattern is similar to the Triple Top. Sell after the price crosses the support level downwards.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Triangle Patterns

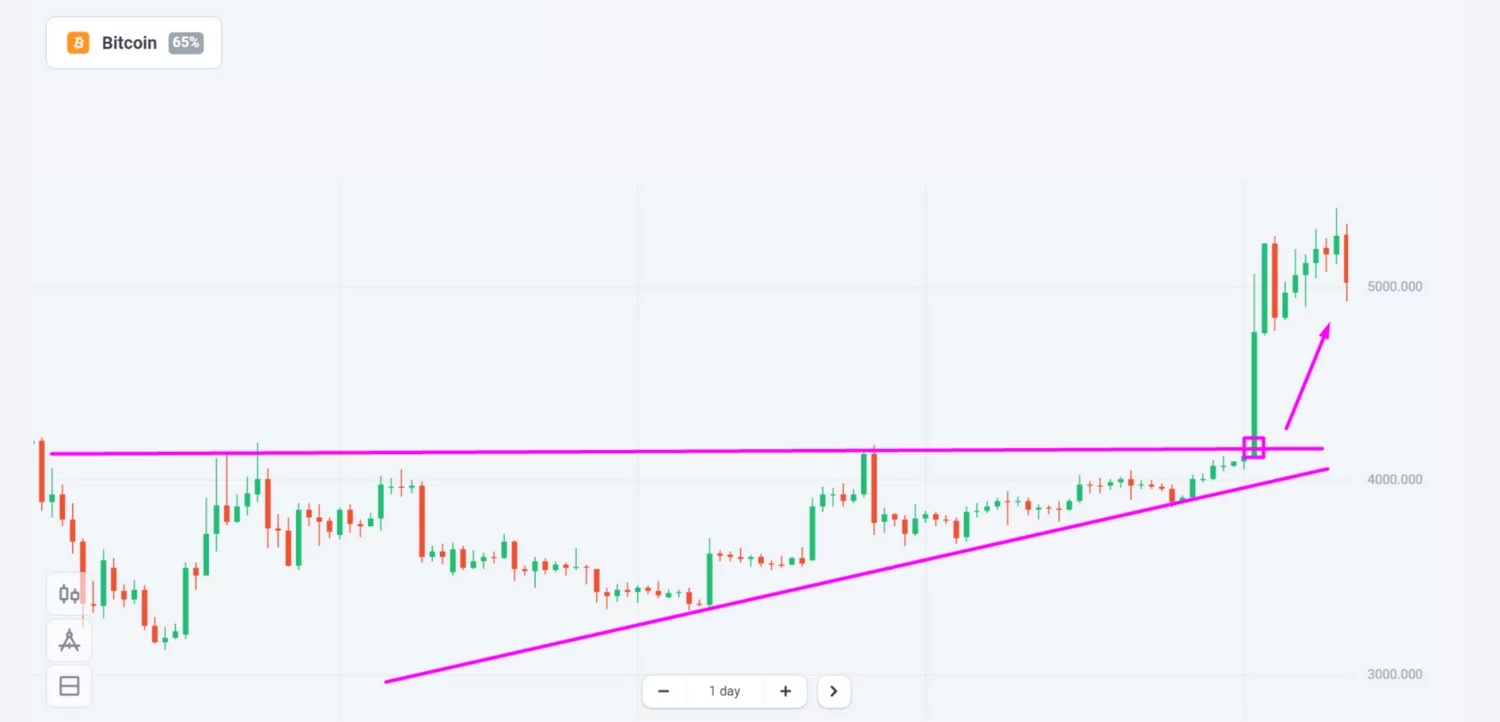

Ascending Triangle (Precedes an Uptrend)

While the same level highs form the upside of the triangle, higher lows form the upward inclined lower side.

Usually, the triangle is followed by the resistance level breakout. Therefore, you may want to buy before the breakout and sell after, but it’s better to wait till the breakout occurs and buy when the price breaks the line.

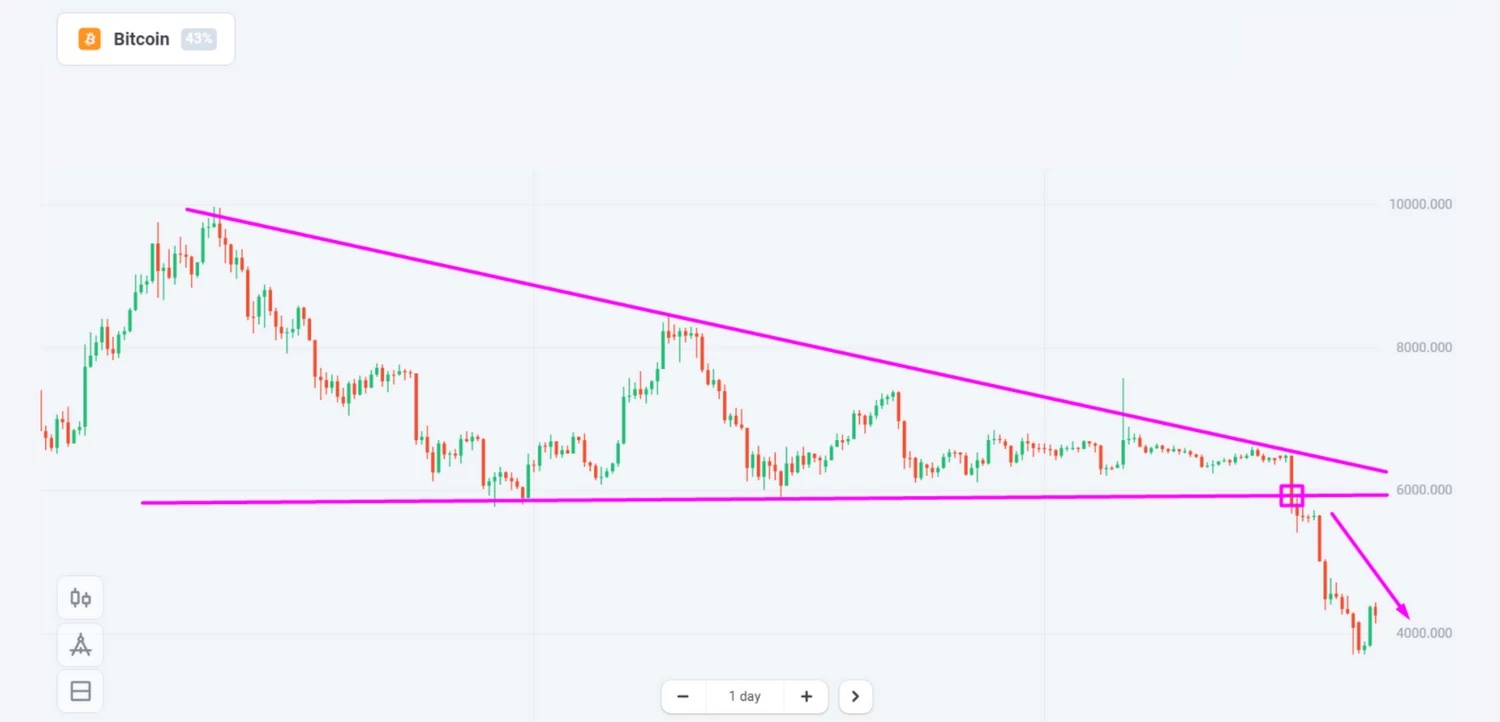

Descending Triangle (Precedes a Downtrend)

While the same level lows form the downside of the triangle, lower highs form the downward inclined upper side.

Channel Patterns

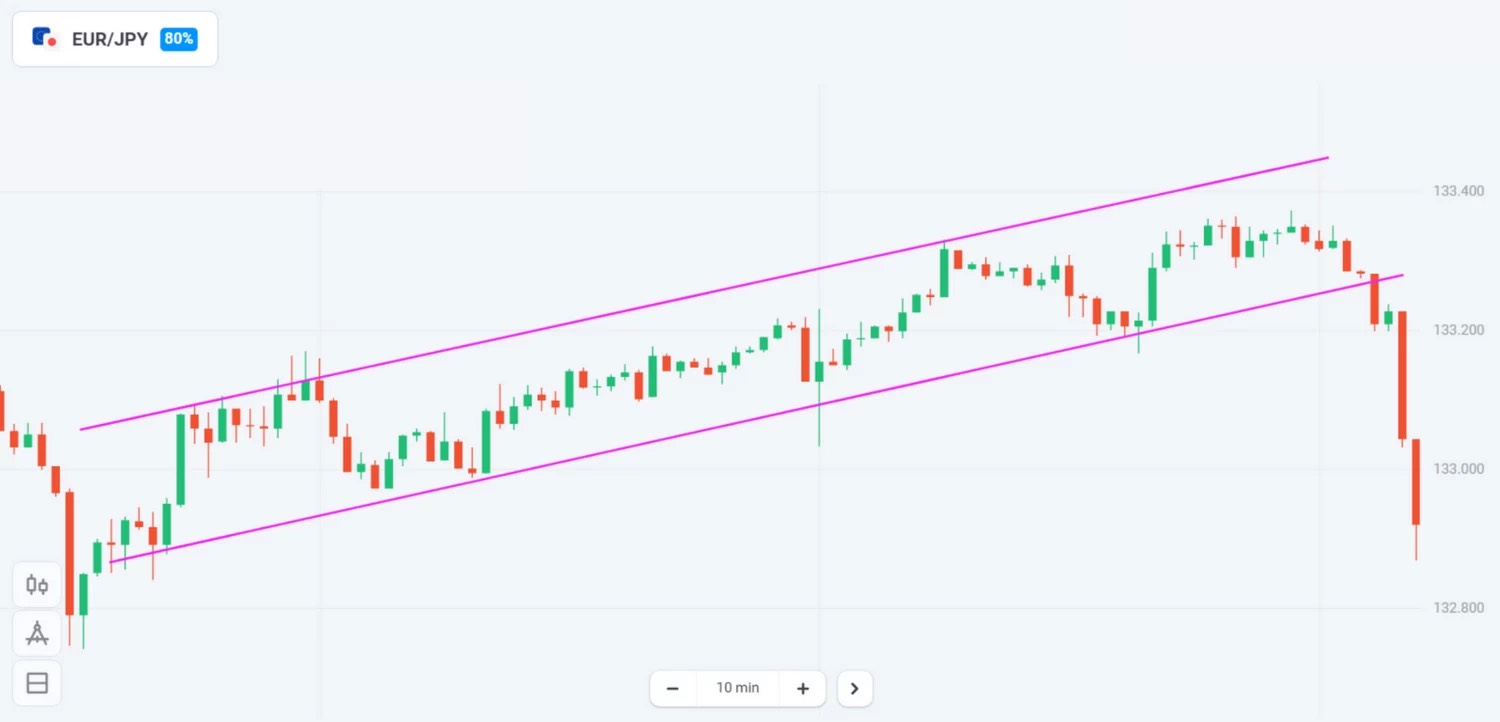

Ascending Channel (Uptrend)

The local peaks of the uptrend fall into a line which forms the upper side of the channel. The local lows of the uptrend fall into a line which forms the lower side of the channel. Both sides move in parallel.

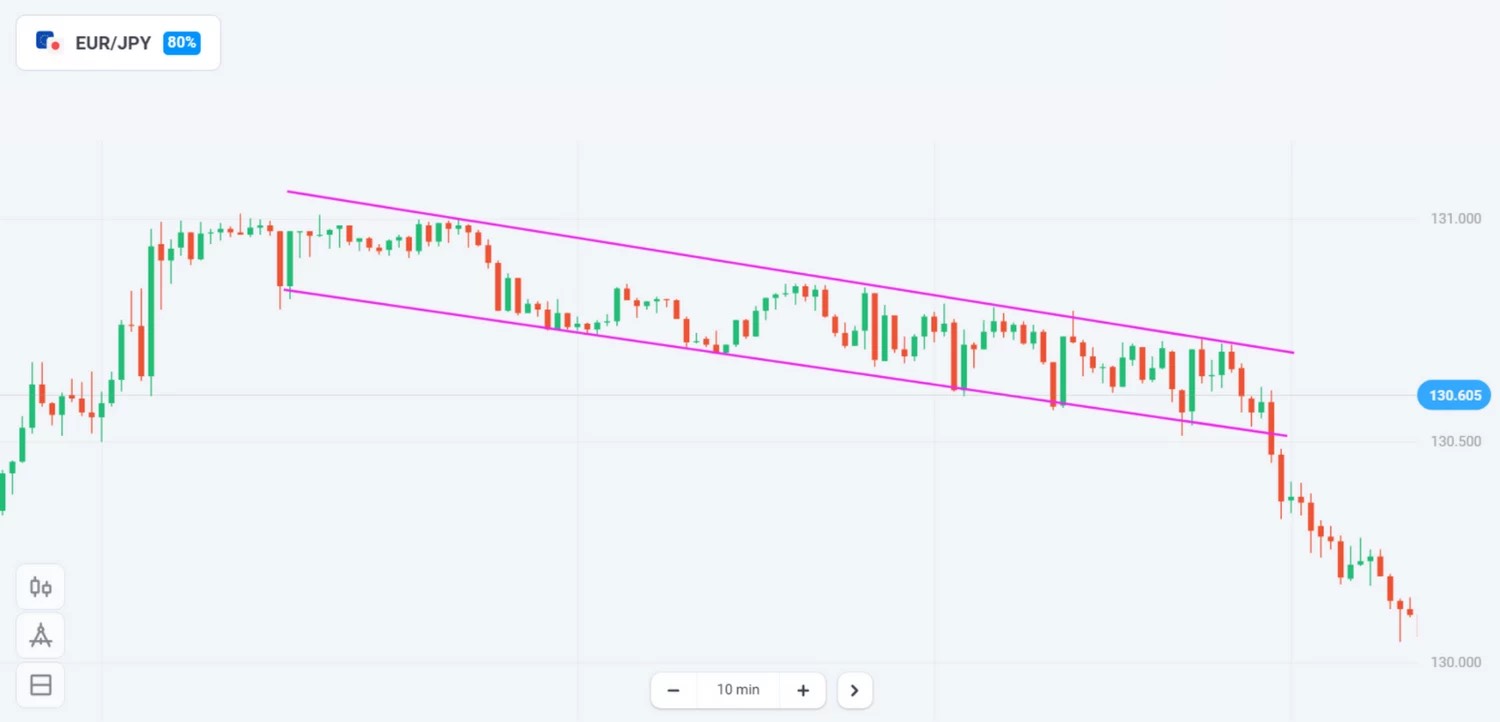

Descending Channel (Downtrend)

The local peaks of the downtrend fall into a line which forms the upper side of the channel. The local lows of the downtrend fall into a line which forms the lower side of the channel. Both sides move in parallel.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

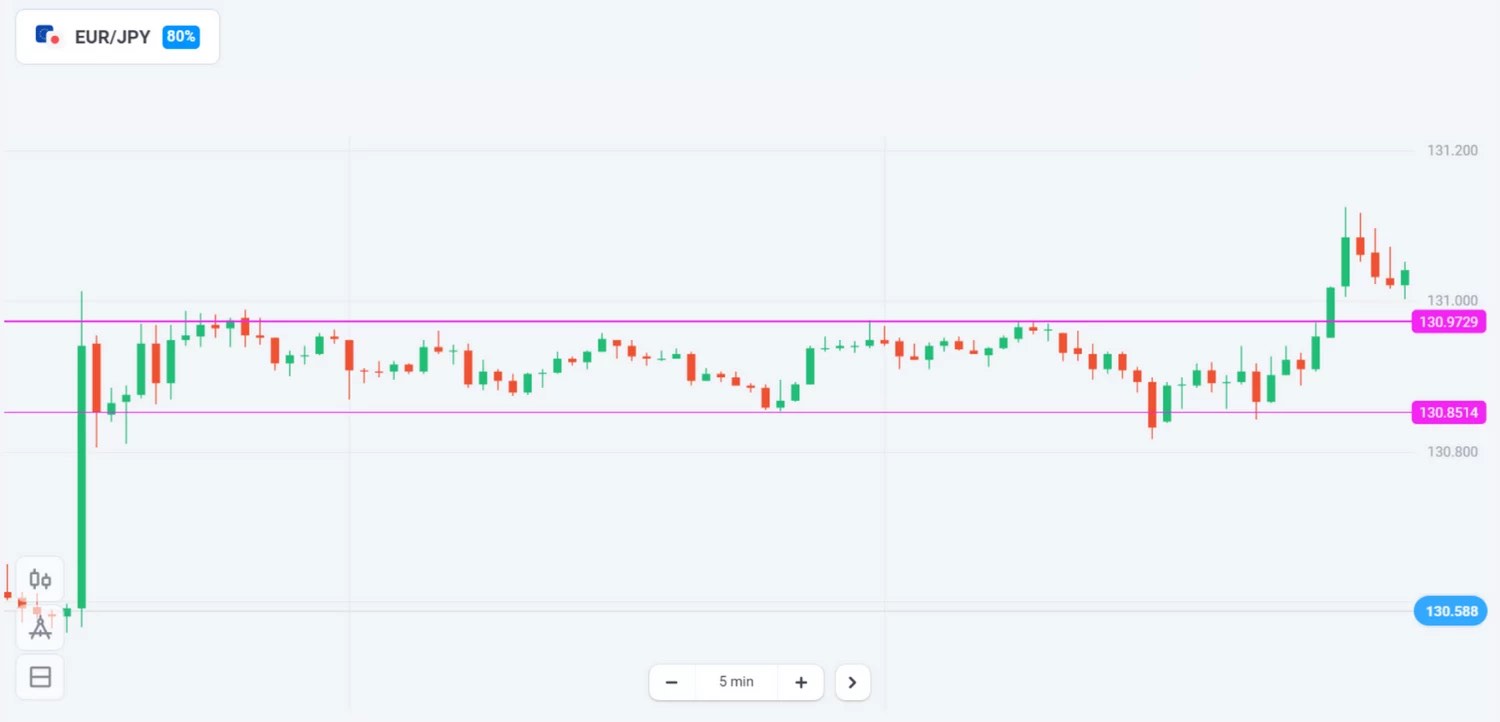

Flat (Sideways Movement)

Highs and lows form the horizontally parallel support and resistance levels that keep the price movement within a range.

The easiest way to trade all three chart patterns is to sell at the highs that are expected to fall into the channel’s upside and sell at the lows that fall into the downside. The tactic is based on the expectation that the channel keeps going for a while after you spot it.

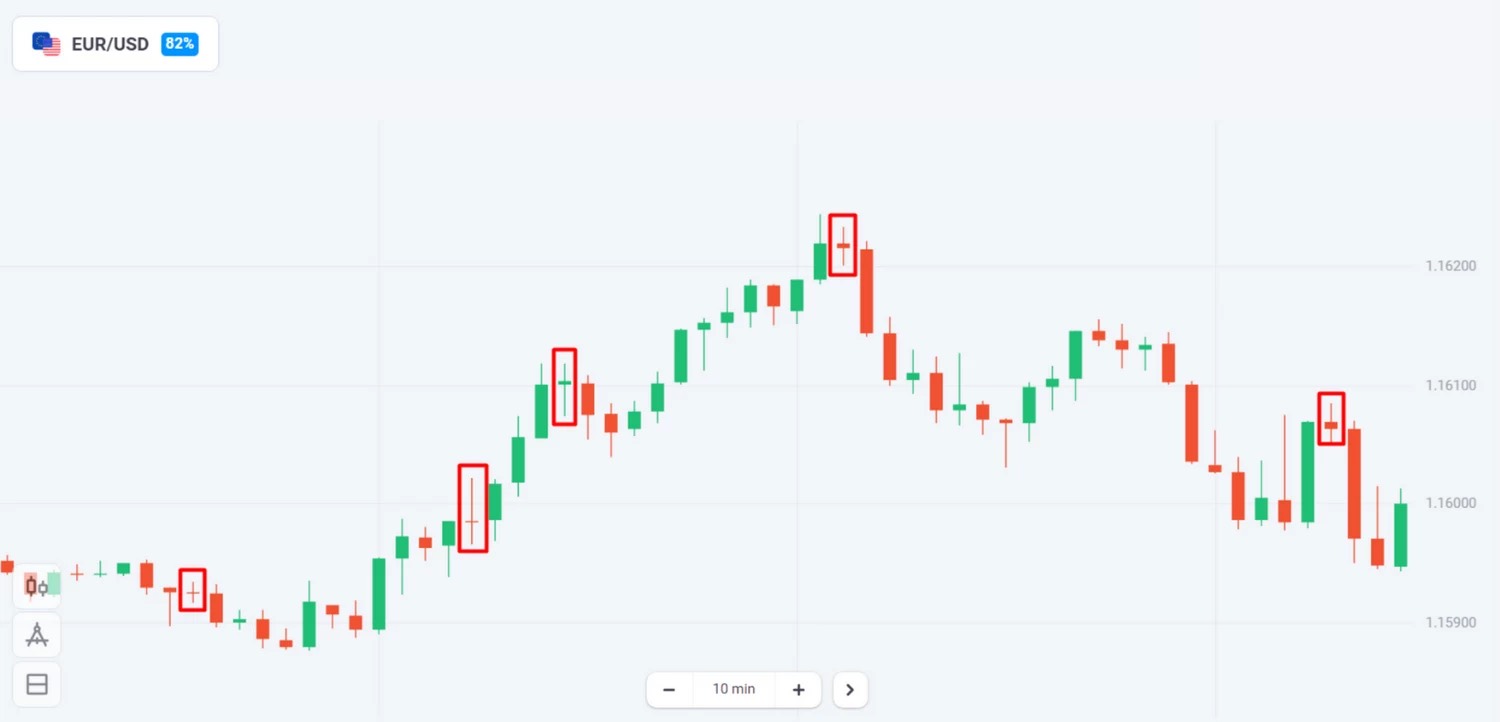

Doji

A Doji is a chart formation that is widely used due to the ease of spotting it. It’s a single candle pattern, and it may come as both a green or a red candle. It features a very thin body and long shadows.

Usually, it means that the bullish and bearish momentums in the market are equal. In other words, it indicates the market’s indecisiveness.

After this pattern, you may see trend reversals, market consolidation, or other price movements. As there is too much uncertainty about what comes next, our usual recommendation is to close your positions on the corresponding instrument in this case.

Time to Act on a Chart Pattern

Rushing to trade after observing a technical pattern is one of the most common trading mistakes. Whichever chart pattern you use, make sure you see it clear before opening or closing a trade.

For example, in a three candlestick pattern, it is important that the body of the third candle completes itself. With trend reversal patterns, it is important to wait for confirmation of the reversal. These rules can help you minimize your risk of experiencing a sudden change in price direction that can happen any second, invalidating your pattern analysis and turning your rushed trades into losses. .

In addition, although there is no rigid validity period for the signals you get from chart patterns, you must act in time.

For example, a long-term trend observed across multiple candlesticks on the daily timeframe might give you a few days to make a decision. The trend reversal observed on the 15m timeframe means you must act within the next 30 minutes.