![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

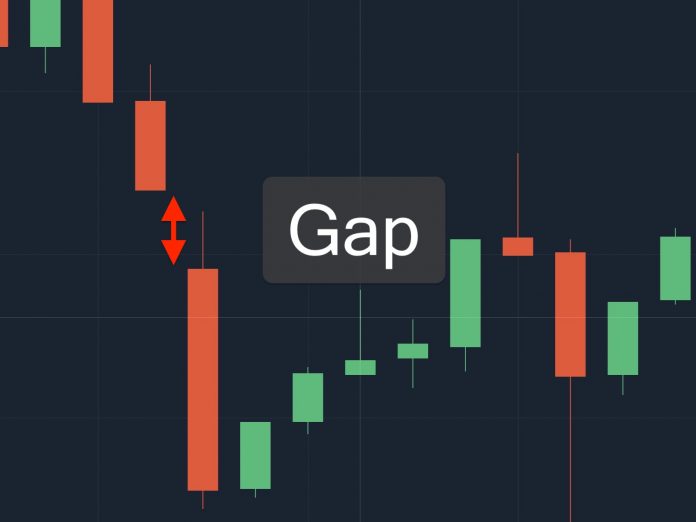

Gap in the analysis of currencies, stocks, virtual currencies is a common occurrence. The reason is the sudden price increase/decrease at the end of the session, making the closing price no longer the opening price of the next candle. So what is its effect on predicting profits?

Gap candlestick pattern

Gap means

The candlestick price is usually very stable in each trading session, the closing price will be the opening price of the next candle. The case of Gap shows that the market has news of sudden price impact. Only in a millisecond, the chart cannot keep up with the price, creating a gap. The larger the span, the stronger the effect of the Gap model on the next trend.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

How to recognize Gap

There is a gap between the opening/closing of the previous candle and the closing/opening of the next candle. The larger the gap, the more clear the next price trend.

How to use the Gap candlestick pattern to make money

Gap trading strategy is very useful but it does not usually appear at a lead pattern. Traders only use it as advice for analyzing other indicators.

Support/Resistance levels

Depending on how the Gap candlestick pattern is formed, a resistance or support level will form. Now you will use it as the Support and Resistance indicator to find when the price will reverse. The high possibility that the price touches the Support and Resistance lines created by Gap going on occurs a reversal.

Market trends when forming Gap

Such sudden price movements may have been affected by the news, the price trend is also affected. You need to analyze more indicators at the same time to make sure the price will change in the direction of Gap. If the Gap appears with a bullish candle, the trend is upward, the Gap with a bearish candle, the price will downward, the larger the gap created, the more likely the new trend will be created.

![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.