There are many factors that come together to determine how successful your trading will be. Among them, accurately forecasting prices and knowing when and where to open a trade are key. This article shares ten simple techniques that can help you identify good market entry points. It will be useful for beginners in formulating their strategies and for advanced traders to expand their list of trading methods.

Chart analysis based on technical analysis patterns

Analytical methods are largely based on observing the development of a trading asset on a chart and opening a trade based on that observation. This approach began to be researched and developed in the early 20th century. Currently, studies have provided a multitude of patterns from which all traders can find patterns that are suitable for their trading strategy.

Applying technical analysis is very simple. Basically, you just need to find one of the learned basic patterns that appear on the chart. It will give a hint as to where the price is likely to develop after that, you will open a trade in the respective direction and wait for profit taking.

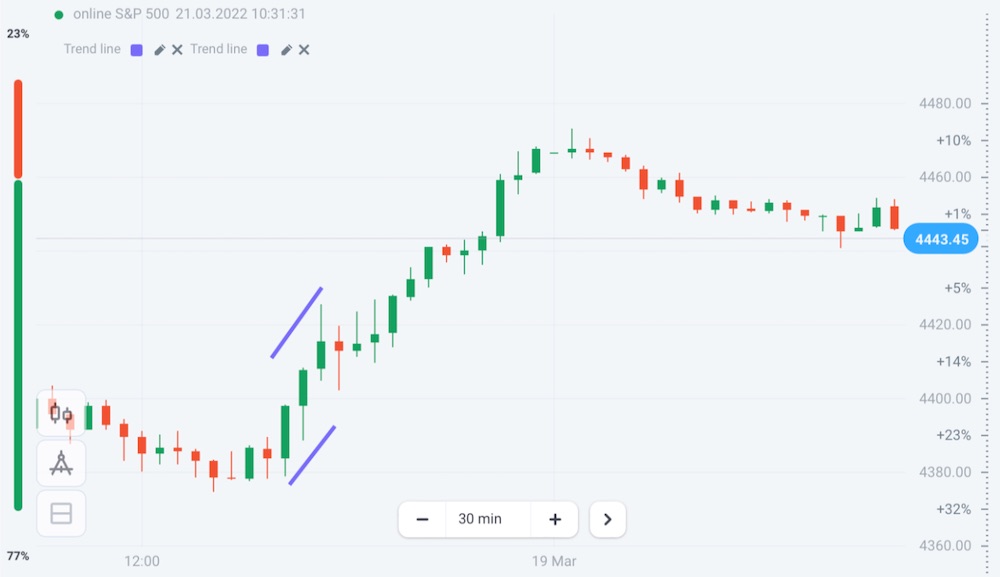

For example, on the 30-minute S&P 500 chart below, we can see a sequence of three green candlesticks. Such chart formations are usually preceded by a strong uptrend. Therefore, upon seeing this pattern, traders will open a buy trade upon completion, remember to place a Stop Loss order at the low of the candle below.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

With current market knowledge there are many interesting patterns and there will always be some that you can observe on the chart. All you need to do is study them.

As a result, you will have a solid base of technical analysis patterns that underpin simple trading strategies that are always ready to use.

Trade on Economic News

Fundamental analysis is basically trading based on news that has the potential to affect the price of your trading asset.

Such news could include any major corporate announcements, quarterly company earnings reports, changes in executives, monetary policy reports, interest rate press conferences of other major companies. country banks, employment data, inflation dynamics, global oil consumption, production forecasts, and more.

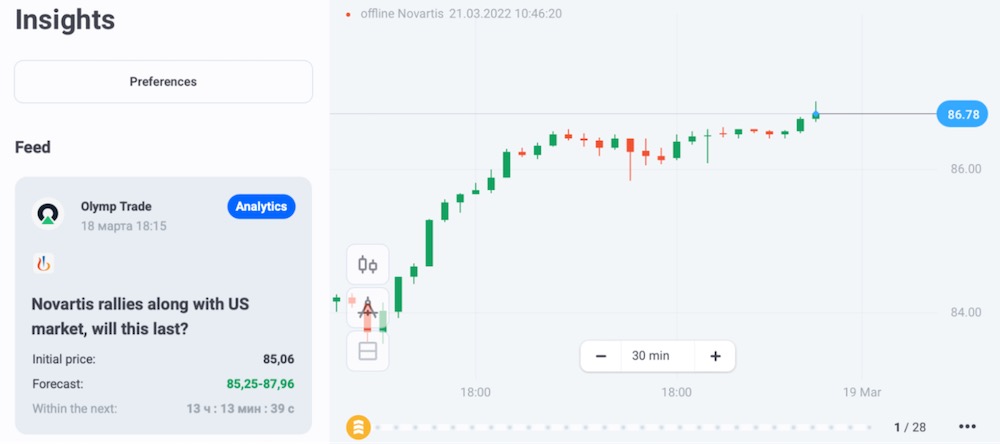

Almost every day there is news that will affect the trading market. Olymp Trade’s Insights will help you monitor this news, see which assets it refers to and open trades in the corresponding direction.

Trading based on the company’s Income Statement

Following a company’s earnings report is part of a fundamental approach to economic news. Because trading on the analyzed income statement is so common, it deserves a separate explanation as to why it’s so good.

First, the income statement is updated regularly. Companies share their performance results every three months.

Second, most reports come in the same three to four week period, commonly known as Earnings Season.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

It is useful because you can spend two “empty” months researching the stocks you want to trade. Then, during the reporting month, you make trades on all the stocks together.

Third, there is no chance that you will miss Earnings Season as the Olymp Trade platform will give you advance notice via email or news. It also informs you what reports come in for the respective week and suggests tips for opening a trade on it. Furthermore, you can enhance your knowledge about Earnings Season with the Help Center section on the subject.

Finally, it is not uncommon to see really large price movements on reports. As a result, the income statements are likely to offer good profit opportunities.

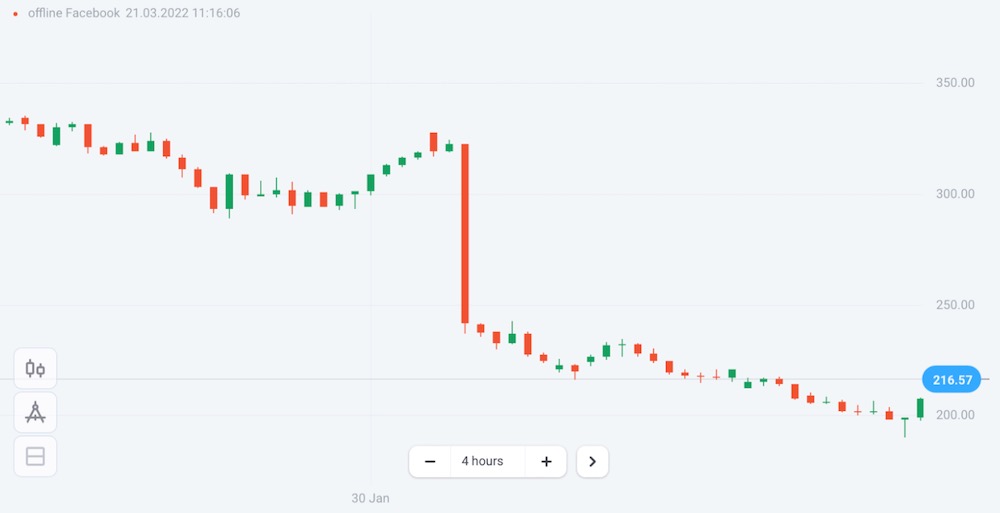

For example, the long red candlestick on the chart below is what happened to Meta (Facebook) stock price after it reported earnings in February 2022.

Price action trading strategy

Price action best suited for day trading. It relies heavily on evaluating candlestick formations in relation to support and resistance levels. Often, such an understanding will help find trend reversals or developments. These are usually very good entry points.

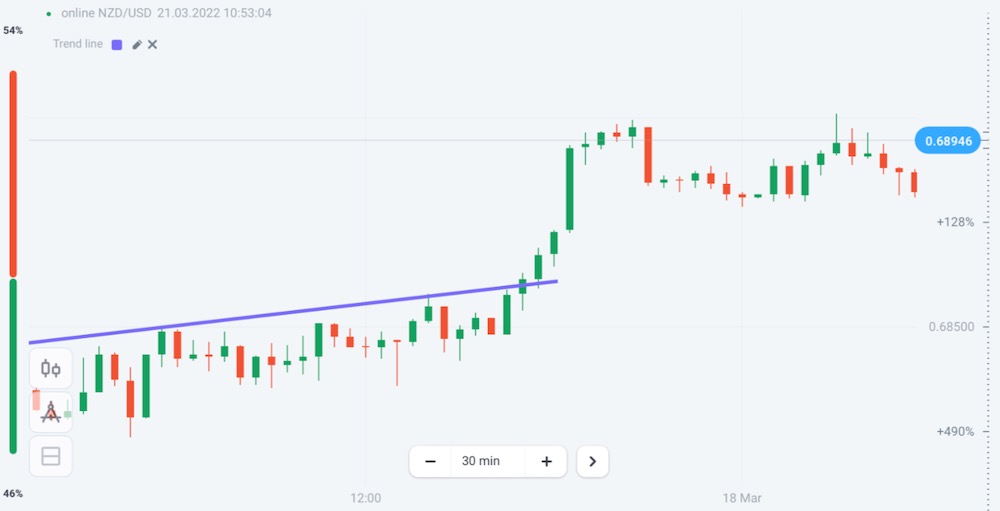

For example, on the NZD/USD chart below, we see a slight uptrend. It continues to form as long as the price moves back and forth through the indicated resistance line. It was then confidently broken and price continued to establish itself at a higher fundamental level. Therefore, when traders see a break of this resistance line, it would be a good time to open a buy trade.

Fibonacci method

The Olymp Trade platform provides two indicators belonging to the Fibonacci group, Fibonacci Levels and Fibonacci Fan. They are accessible through the Indicators menu.

Fibonacci indicators are technical tools to indicate price levels that may reverse or accelerate.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Therefore, they can be used effectively to identify market entry signals.

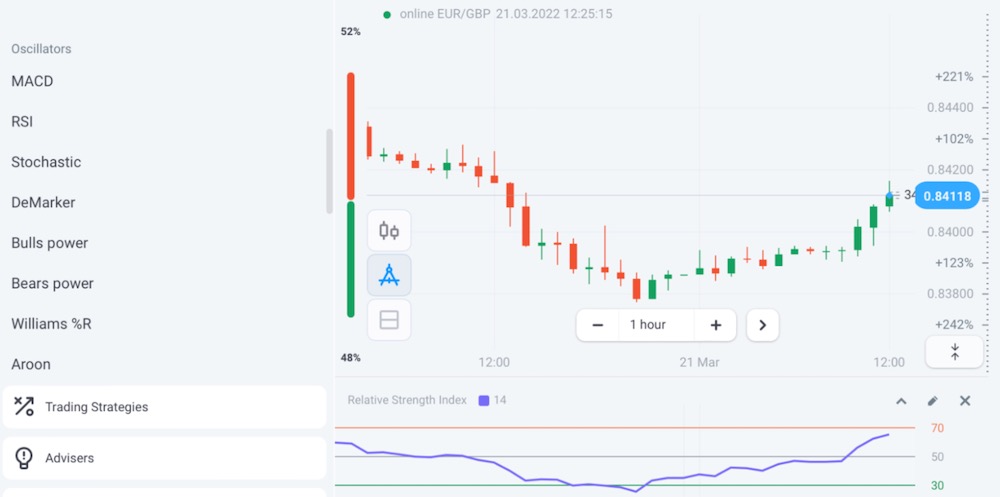

Oscillator

Taking a trade on a trend reversal can be a highly effective intraday strategy. Oscillators are a very good tool for that.

Oscillators are a technical analysis tool used to see the strength of the trend at a certain point and check if the price is in the overbought or oversold zone. It will then indicate a possible trend reversal.

If you look at the 1-hour chart of EUR/GBP you will see that the lowest point of the price is 0.8380 which corresponds to where the purple line of the RSI drops below 30 which is the oversold zone.

When the RSI crosses that level from the bottom up, it will be a sign that a new uptrend is forming and it’s time to open a buy trade. This is the usefulness of an oscillator.

Reciprocal Strategy and Trading Psychology

Trading on “scary” news is another specific part of news trading, on a larger scale it is part of fundamental analysis.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

This approach is based on the logic that the market reacts quickly to any major pessimistic announcement. Whether such an issue was later confirmed to be an economic threat, it really did not matter. The market is made of people, and people are based on emotions. As a result, they often react emotionally even to something that may in fact be an exaggerated and negative personal opinion or one of many possible outcomes.

For example, a threat to current global oil production could push up the price of Brent oil. Or a security incident at an ARAMCO site in Saudi Arabia or a military escalation in the Middle East that oil-producing countries like the UAE or Iraq fear could be a scenario for the oil trade.

In other words, any major tensions announced by world leaders could also be news to trade. In 2018, at a time of US-China economic confrontation, the media often shared alarming quotes from the country’s leaders and observers.

Finally, in 2020, as news of the spread, impact and consequences of Covid-19 spread in the media, the stock market ended up losing up to 30% of its value. Therefore, if you are trading during a market panic, it is the right time to do so. In the future, any such news is a good candidate for this type of trading.

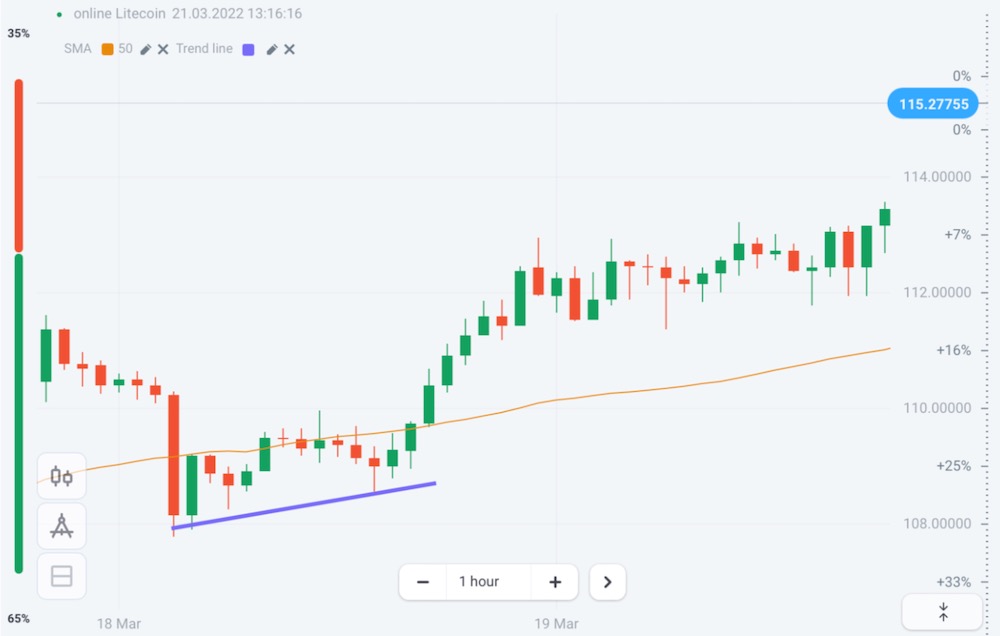

Simple Moving Average

The Simple Moving Average, or SMA, is one of the most effective and easy to use trend indicators.

One of the simplest ways to use it is to analyze the chart to see if the price of an asset crosses the SMA in an up or down direction.

If the price rises above the SMA, it is a signal to open a Bull trade.

If the falling price crosses the SMA, it is a signal to open a Down trade.

For example, on the Litecoin chart below, the price has gone below the SMA set at 50 periods. After staying there for a while, it confidently crossed the SMA up. For many traders, that means opening an Up position after the trade goes up there.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Trade with Olymp Trade Analysis and Signals

Olymp Trade experts regularly publish many analytical reviews that you can use to trade.

These Expert Analytical Reviews provide price forecasts for various assets, effectively supporting quick and informed trading decisions.

In addition, you can find useful information on the Olymp Trade platform about advisors and trading signals. Both can be effective technical tools to improve the outcome of your trading process.

Personal Consultation

Through Olymp Trade, you can use the help of a personal trading advisor by upgrading to an expert. This is an option available with varying frequency on both Advanced and Expert status.

Advanced Traders can have one individual consultation per month, Expert Traders can have four of them.

In both cases, these consultations are scheduled through Olymp Trade support.

This tool can help traders form a customized learning process to get them to the required trading level faster. In addition, they can see real market examples of trading and risk management decisions made by an Olymp Trade expert.

Discover and Combine

This list does not contain all possible trading methods that you can apply with Olymp Trade. Instead, it shows you different directions you can follow to discover the ones that best suit your trading goals.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.