![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية ![]() ไทย

ไทย

The classification of traders might seem sketchy. However, there is a clear division between them based on the period of holding an open position. If your strategy involves holding trades for a period from two days to several weeks, you can call yourself a swing trader.

As a rule, traders start making swing trades after gaining some experience. For many of them, holding trades for a longer period is the only way to carry out their work assignments while trading on Olymp Trade.

The demand for smart and conscious trading styles makes us pay attention to swing trading. Let’s try to understand its advantages over day trading and give some basic recommendations for developing your own trading strategies.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

The Difference Between Day and Swing Trading

Most novice investors begin with day trading. This is due to the trader’s desire to have a stable daily income, similar to the way workers get paid by their employers.

Here are the major features of day trading:

- Traders don’t hold positions overnight or over the weekend.

- Day traders have a good understanding of trading hours (they know when to trade and refrain from trading). They set Stop Loss less often and don’t leave their work when their trade is open.

- Also, they tend to use trading strategies designed for scalpers and trade in a news-fueled volatility market.

- They hardly ever analyze timeframes higher than 1-4 hours.

Day traders often refrain from in-depth fundamental analysis and do not monitor the geopolitical situation because such forecasting methods are ineffective for the short term.

As for the swing traders, they don’t have to monitor their positions non-stop since they use Stop Loss and Take Profit.

Experienced swing traders are like shrewd hunters who can wait for a long time until they make a profitable trade. But they can significantly increase their capital by making a few successful trades within several days.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Basic Strategies for Swing Trading

To make sure you understand what swing trading is about, you should learn about the basic characteristics of the popular trading strategies that match this style. We will now give an example of a system based on technical analysis and outline basic recommendations on how to use fundamental analysis in swing trading.

Key Levels

Every asset has its key price levels. Key levels are a broader concept than support and resistance levels, trend lines, and so on.

Here we deal with different period moving averages, the most significant trade volume levels, and historical lows and highs. Many investors make their trading decisions depending on the position of the asset price relative to some level.

That is, if the quotes are slightly below the resistance level, traders will be inclined to sell stock, currency, and commodity assets. And if the asset price is close to some significant low, traders will start actively buying.

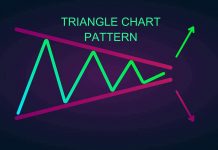

Following the trend is another popular choice of swing traders. As soon as they do not have to follow the market closely after opening a trade, these traders need an extra safety net. A trend traditionally acts as such a protection measure.

Therefore, the signals of trading strategies based on the concept of key levels can be presented as follows:

- A breakout of a key level from bottom to top means it’s time to buy.

- An unsuccessful breakout of a key level from bottom to top or a false breakout is a sell signal.

- A breakout of the level from top to bottom is a signal to sell.

- A false breakout of the support level (in any direction) or any signs of the support level stability give traders a signal that it’s time to buy the asset.

All you need to fully prepare to implement a unique trading method is to choose the key level type, decide on the risk management, test the system, and go to conquer the market.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Fundamental Analysis for Swing Traders

Fundamental analysis can lift the veil of secrecy on the direction of the price movements in the near future. To be able to forecast it, one needs to review the latest macroeconomic reports.

Start with a consumer price index, an indicator that measures the level of inflation in the country. Its gradual growth indicates the stable state of the economy and its development. You can also compare a country-specific index with the global data or the same index values in neighboring countries.

Then review the data on consumer confidence and retail sales. Nothing characterizes the situation in the country and shows the level of confidence in the future better than people’s behavior.

For example, the U.S. consumer confidence index was steadily growing for 5 of the 6 months in the second half of the year 2018. At the end of the year, the S&P 500 stock index was quoted around 2,400 points. A year later, this instrument was up over 30%.

Key business indicators are also worth knowing. They can include services and manufacturing purchasing managers’ indices. These two indicators have quite a strong impact on GDP, which is a major economic indicator.

Try to find trends and chart patterns in the abovementioned reports that will help you get ahead of the market curve. Such an analysis enables traders to open trade before an important news release and profit from their correct forecast. Of course, traders can’t predict a force majeure, but that’s what they have risk management for.

We remind you that the trading conditions in the Forex mode of the Olymp Trade platform ensure negative balance protection.

![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية ![]() ไทย

ไทย

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.