![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية ![]() ไทย

ไทย

Technical analysis is a fundamental skill for traders looking to capitalize on trends, pullbacks, reversals, and other price action types. This article will give an overview of how to use technical analysis when trading on the Olymp Trade platform.

What Is Technical Analysis?

Technical analysis is the practice of using chart data to determine which direction prices are most likely to move. Traders use tools and specific charts to help them ascertain as much information as possible about price movement.

Our article, Fundamental vs. Technical Analysis: Understanding the Differences explains the nuances of the two types of analysis and is a great introduction to technical analysis on Olymp Trade.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Reading Charts on Olymp Trade

Using technical analysis starts with a basic understanding of price charts. There are four types of charts on the platform; Area, Bars, Heiken Aishi, and the most commonly used Japanese Candlesticks.

Forex traders want information as quickly as possible and depend on the Japanese Candlesticks to deliver it. Though Bar and Heiken Ashi charts display similar details, they are less popular among traders.

A chart shows the past and current price actions of an asset. Looking at the Amazon daily chart above, you can see how much the price of Amazon’s stock moved in a trading day. Each candle represents an entire trading day. The candles correspond with the Time Frame. Therefore on a five-minute chart, a new candle would be created every five minutes.

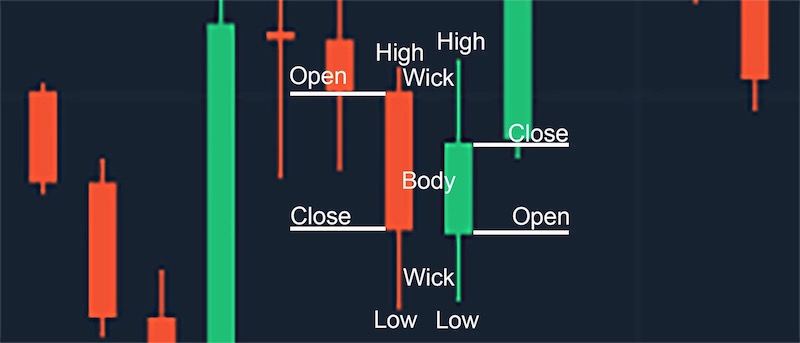

Each candlestick tells four things – the high, low, open, and close.

The body and wicks make up each candlestick. Looking at the candle, you can see the highest and lowest price the asset reached a period, shown by the wicks’ ends. The open and close show where the price was when the time period began and ended, the area between them forms the body.

Candlesticks have a story to tell. Whether the body is green or red tells whether the price rose or fell.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Green is a Bull’s story of buyers trying to push the price higher. The wick indicates the high, but it also shows price rejection, when the buyers pushed the price back down before the close and no longer chased prices. Low wicks, below the body, are the opposite; they show buyers’ rejection of lower prices.

Red candlesticks tell the story of the Bears and their fight to push prices lower. High and low wicks tell the same tales of price rejection.

How to Identify Trends with Olymp Trade

A trend is when prices move in the same direction for an extended period of time. They rise, fall, and plateau often requiring a large external force to change direction.

The most common way to identify trends is to use Trend Lines (red lines above) to connect a series of highs or lows. Once connected, it will be easy to establish which direction the asset’s price has been trending. These lines help mute the noise of the individual candles, resulting in a clear delineation of an asset’s movement.

The more candles that touch and move along a trend line, the stronger the trend.

Uptrend

The line connects higher lows and/or opens – indicating prices have continued to climb in the face of pullbacks.

Downtrend

The line connects lower highs and/or opens – indicating prices have continued to decrease in the face of pullbacks.

Plateau

The line connects highs or lows around the same level – indicating prices have remained almost stagnant with little deviation.

Experienced traders know, “the trend is your friend.” A prolonged uptrend is more likely to continue upward rather than reverse and head down. Therefore trading with the trend maximizes chances of success.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Support & Resistance Levels

In technical analysis, support and resistance levels are used to identify price points on a chart where the probabilities favor a pause or reversal of a trend. The support level is where an asset’s price repeatedly stops falling and bounces back up, while the resistance level is where the price stops rising and dips back down.

They are a primary barometer of long-term market sentiment.

- Support – where a downtrend is expected to pause due to a concentration of buyers (demand).

- Resistance – where an uptrend is expected to pause tentatively, due to a concentration of sellers (supply).

There are many complicated ways to calculate the support and resistance levels. The simplest way to determine an asset’s support or resistance levels is with trend lines.

Though support and resistance levels can match trend lines, they can also be at a single price point, stopping prices from rising or falling.

Assets are essentially rubber balls that bounce off of the “floor” or support and reflect off of the “ceiling” or resistance.

Imagine that the ball, mid-air, changes to a cannonball. The extra force of increased volume will drive the ball through the resistance level; or it will crash the ball through the support level on the way down. Either way, extra force, or enthusiasm from either the bulls or bears, is needed to break through the support or resistance.

A resistance level becomes a support level when prices rise above it and consolidate there. A support level turns into a resistance level when the price falls below it and fixes there. The more a support or resistance level has been tested, the stronger it is.

However, as pullbacks shorten and volume rises with each bounce or reflection the asset’s price ball gains momentum and is more likely to break through the line. This phenomenon is the reason for two strategy types.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Trading Pullbacks and Breakouts

Rebounds and Breakouts are two trading strategies that are based on trends, support, and resistance. Both are risky as price action may oppose your prediction.

Pullbacks

Trades that profit from the pullback (short trend reversal) as an asset tests its support or resistance levels. Basically, jumping into a market that has an established trend and then has turned against that trend.

The most favorable technical conditions for a profitable pullback are a strong trend and sturdy support and resistance lines.

Assets approaching the notable levels (trend lines, support, or resistance levels) present the best opportunity for profit. Vertical price action into a peak or trough with high volume is needed for consistent profits as it encourages rapid price movement. However, the same volatility that makes this type of trading profitable makes it risky.

Look for long wicks showing price rejection against the trend along with increased volume as prices approach the floor or ceiling.

The longer the run between pullbacks, the larger the pullback may be. Each pullback creates its support or resistance level, decreasing the potential for a more profitable trade.

Trades are executed as prices approach notable levels in an attempt to capitalize on the entirety of the pullback. Using previous support or resistance established at previous pullback highs or lows.

Breakouts

Trades that profit from an asset after it has broken through its support or resistance. A breakout trader enters a long position (prices will continue to go “Up”) after the price breaches above resistance or opens a short position (prices will continue to go “Down”) after the stock breaks below the support. This is an important signal that our Olymp Trade expert shared.

Breakouts are potential trading opportunities that occur when an asset’s price jumps above a resistance level or drops below a support level because of an increase in volume. After an asset trades beyond the notable level, volatility increases, and prices often trend in the breakout’s direction.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Breakouts are an important trading strategy because the setups are the launchpad for future volatility increases, huge price swings, and major price trends. But like any strategy, profits are not guaranteed.

First, when trading breakouts identify the current price trend as well as support and resistance levels in order to plan entry and exit points. Unlike Pullbacks, Breakouts require a channel created by the support and resistance lines. This channel means prices are likely to make a large jump or drop after breaking through either barrier.

The more a notable level is tested, the more important it is, and generally, the weaker it becomes and the greater the chance of a breakout.

After entering either a Pullback or Breakout trade, determining when to exit the trade when trading forex depends on a number of factors. As a general rule, when momentum slows, be ready to exit the trade to capitalize on profits.

When executing Fixed Time Trades following either strategy, set the trade Duration to the same interval as the chart’s Time Frame to minimize confusion and capture the full momentum of the candle.

The Trend Is Your Friend

Technical analysis is the practice of using chart data to determine the coming price action for an asset. Understanding charts, trends, support, and resistance levels help traders understand how a security’s price has moved and its potential future moves.

Technical traders use these basic tools to build different strategies. Pullbacks and Breakouts are two basic types of technical strategies that utilize these core concepts to profit. Remember, the more attention a notable level gets, the more important and likely to breakdown it is.

Technical analysis is a skill that requires study and practice. Use your demo account to become comfortable with these strategies and prepare yourself to reap profits.

![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Português

Português ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية ![]() ไทย

ไทย

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.