The Forex market, with its daily trading volume of $6.6 trillion as of 2019, is a crucial financial market globally. Understanding how it functions is essential to gain a competitive advantage over other traders. With the growth of the internet, the Forex market is constantly attracting new traders, adding to its daily trading volume.

To trade successfully in the Forex market, it is necessary to have a good grasp of its workings, especially the exchange rates in the global currency market. Let’s explore this further.

What is a currency exchange rate?

An exchange rate represents the value of one currency in comparison to another. Various factors can cause its fluctuation, which we’ll delve into. A currency pair is used to indicate the exchange rate between two currencies, where the first currency is known as the base or transaction currency, and the second is referred to as the quote currency.

The arrangement of a currency pair reflects the value of the base currency in relation to the quote currency. For instance, in the EUR/USD pair, the rate is $0.9985, signifying that one euro is equivalent to 0.9985 US dollars.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Types of currency rates

Exchange rates for a currency can either be floating or fixed (tied to another currency).

Floating exchange rates are subject to changes based on the supply and demand of both involved currencies.

Fixed exchange rates, on the other hand, are typically established and controlled by a country’s central bank. In some cases, the central bank may peg its own currency to a foreign currency, resulting in its value being influenced by the exchange rate of the pegged currency.

How currency is exchanged

Currency exchange is carried out in three main ways

Financial organizations, typically banks, conduct the buying and selling of currencies both online and offline.

One can also earn from exchange rate differences through stock market trading.

Additionally, global Forex platforms provide traders the opportunity to trade in world currencies.

The most popular currency pair

Let’s examine the interaction between two currencies when paired.

The EUR/USD currency pair represents the proportion of euros to US dollars. In this pair, the euro functions as the base currency, while the US dollar is quoted. The EUR/USD pair is widely popular in the Forex market and can be easily traded on Olymp Trade in both Forex and Fixed Time Trades modes.

From the chart, it can be seen that the EUR/USD pair is below parity and trending downward, due to the European Central Bank’s delayed response to inflation compared to the prompt tightening of interest rate policies by the United States Federal Reserve.

The price exhibits significant volatility, with frequent fluctuations offering multiple opportunities for traders to participate in the market.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

What determines a currency’s exchange rate?

Several elements impact the formation of currency prices. Let’s examine the primary ones:

Supply and demand

As in any market, prices are primarily determined by supply and demand. When demand for one currency is greater than another, its price rises, and vice versa. The supply of a currency refers to the total amount available in circulation. Central banks have the power to regulate supply through interest rates and printing, and they, along with other banks, have significant control over the market. On the other hand, demand refers to the number of traders, companies, or investors interested in purchasing a currency.

The economy

A country’s strong economy leads to a valuable currency, attracting investment and boosting demand, which in turn drives up its price. The demand for a currency may vary based on factors such as inflation rate, the state of its industries, interest rate level, its global currency value, and the country’s balance of payments, among others.

Central banks

A central bank has the ability to control the supply of a currency and utilize various tools to impact the international currency market.

Various events

Sudden disasters and geopolitical events, both within a country and internationally, can significantly impact its currency. Conflicts, such as wars, can alter the currency exchange rate of involved nations. The aggressor may also face sanctions from other countries, negatively affecting its trade and economy, and as a result, its national currency.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

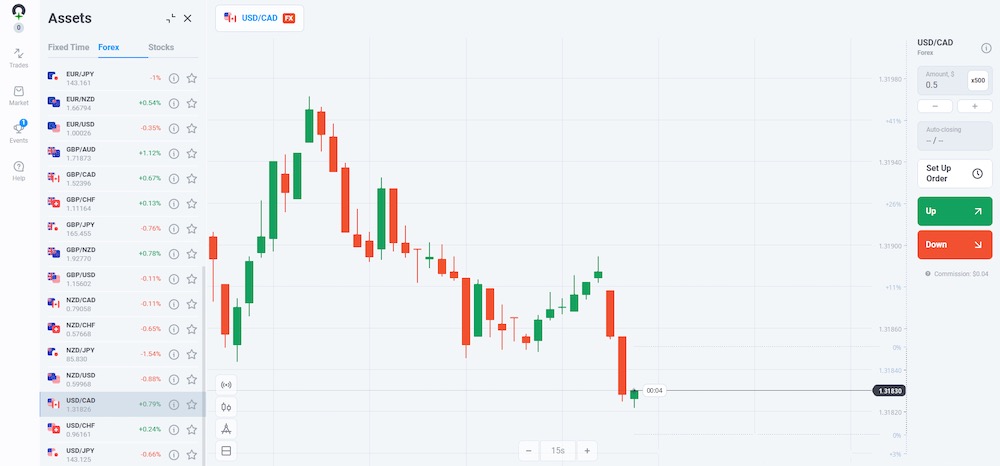

How to trade in Forex mode on Olymp Trade

In order to trade currency pairs on Olymp Trade in Forex mode, follow the instructions below:

- Open an account on Olymp Trade and deposit funds (or use a demo account).

- Open the Assets section and select Forex mode.

- Select the Currencies tab.

- Analyze the market with the help of tools and indicators and choose a currency pair to trade.

- Set the trade amount.

- Choose the amount of leverage (multiplier) and define Stop Loss and Take Profit levels.

- Open an Up or Down trade.

Find out how to open an account on Olymp Trade and start trading in our detailed tutorial.

How to trade in FTT mode on Olymp Trade

In order to trade currency pairs on Olymp Trade in Fixed Timed Trades mode, follow the instructions below:

- Open an account on Olymp Trade and deposit funds (or use a demo account).

- Open the Assets section and select FTT mode.

- Select the Currencies tab.

- Analyze the market and choose a currency pair to trade.

- Set the trade amount.

- Choose a trading time. Most assets in FTT mode are traded for 1 minute, but there are also trades from 5 to 15 minutes.

- Open an Up or Down trade.

Analyzing exchange rates: A real example

Successful Forex traders employ a combination of fundamental and technical analysis when trading. Let’s examine the USD/JPY currency pair using both methods.

For fundamental analysis, it is crucial to understand the economic conditions in both the US and Japan.

The US Federal Reserve is taking strong action by raising interest rates to combat inflation, thereby boosting demand for the US dollar as other countries are not increasing their rates as quickly.

Conversely, the Bank of Japan has a low interest rate policy, which will keep the value of the Japanese yen low.

Fig. 4. Analyzing the USD/JPY pair on Olymp Trade

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

In our analysis of the USD/JPY currency pair, we combined both fundamental and technical analysis. For the fundamental analysis, we evaluated the economic situation of both the US and Japan. We know that the US Federal Reserve is aggressively increasing interest rates to combat inflation, which is boosting demand for the US dollar. On the other hand, the Bank of Japan has a low interest rate policy, leading to a weaker Japanese yen.

For technical analysis, we observe that USD/JPY is in a bullish trend but has reached an all-time high, making a correction likely to the blue trendline near $135.95. Our analysis suggests that the dollar remains strong and the yen is becoming weaker. In the short term, a drop in the USD/JPY pair is possible, presenting a good opportunity for a successful “Down” trade. In the long term, the strength of the dollar is expected to continue, based on the same fundamental conditions.

Move forward with Forex

The currency market can be highly unpredictable, but with the right skills and knowledge, you can take advantage of its fluctuations. If you’re interested in profiting from the currency market, we suggest reading our article on volatility and top trading strategies.

Olymp Trade offers a wide selection of popular currency pairs and all the tools necessary for successful trading. Whether you’re a beginner or an experienced trader, Olymp Trade has resources and educational material available to help you succeed.

Take the time to learn, trade, and unleash your potential with Olymp Trade.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.