![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

Each Japanese candlestick shape has its own meaning; it is elementary to learn about them and understand the meaning. Knowing the names of the candlestick will help you learn the patterns faster. This article will give you the names of the models with all types of candles, from short names to long names.

We believe this is an essential basic article. If you ignore the article, you will have nothing left.

6 types of Japanese candlestick

The purpose of determining the type of each Japanese candle primarily is to help to learn academics. This is important because the beginners will be confused with the types of candles when they are mentioned. Leading to mistakes when actually confusing one with another.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

There will be 6 types of Japanese candles listed below:

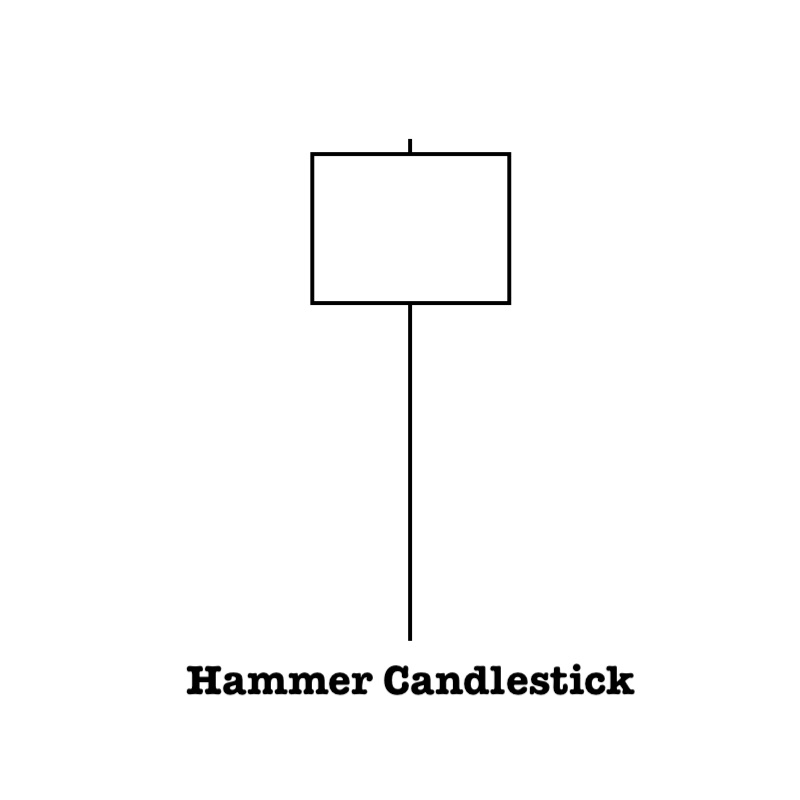

Hammer candlestick

Hammer candlestick has the shape of a hammer with the tip above. The price signal of this candlestick session is about to decline strongly.

When this candle appears at the end of an uptrend and then plummets, it is called a Hanging Man.

Hanging Man identification by:

- It doesn’t matter whether bullish or bearish candlestick because they both indicate that the price is about to drop sharply.

- Hammer candles appeared on an uptrend.

- The tail should be 2 times longer than the real body.

- Candle’s top without the tail.

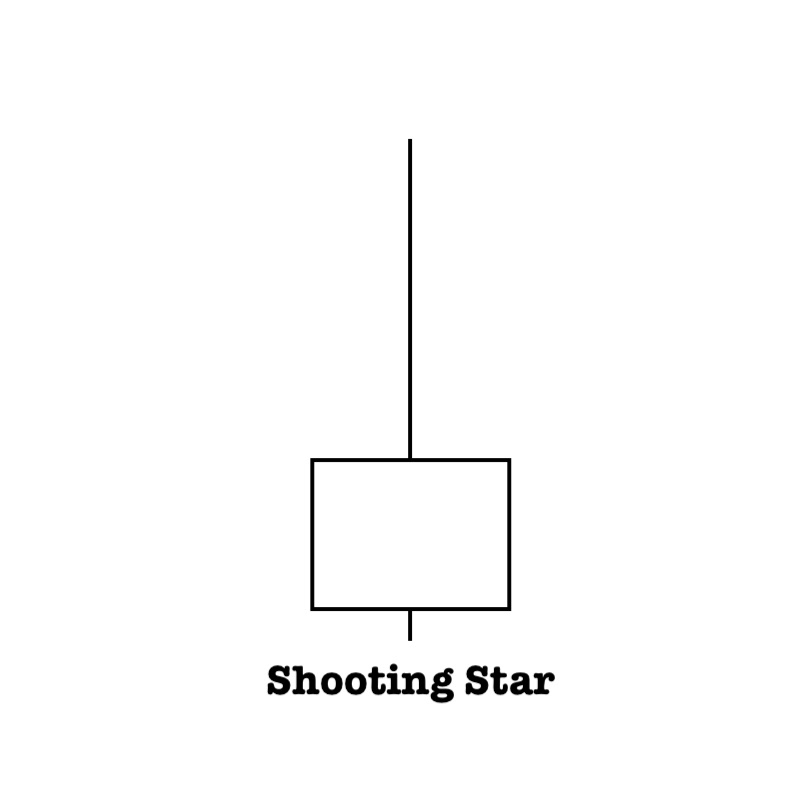

Shooting Star

The low-reliability Shooting Star candlestick in the shape of an overturned hammer. It is the complete opposite of a Hammer candle because it looks like a reversal Hammer candlestick.

When this pattern is at the bottom of a downtrend, it is called the Inverted Hammer.

It doesn’t matter whether it is bullish or bearish. This pattern always signals that the price has solid support and is ready for a reversal.

Note: Inverted Hammer has low reliability.

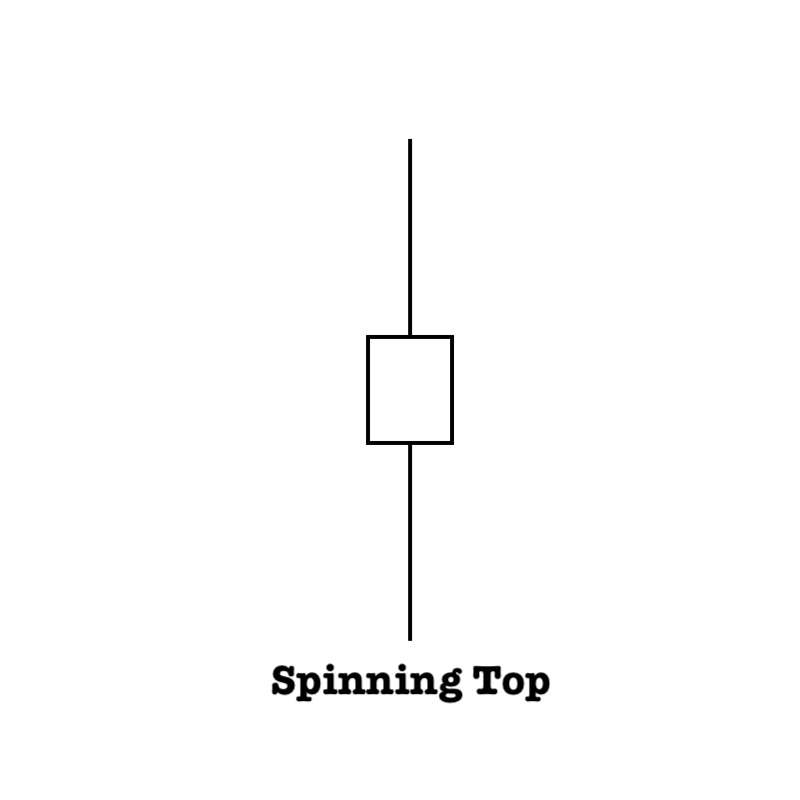

Spinning Top

The Spinning Top is a small candlestick with tails at both the top and bottom the makes it look like a spinning. This expression shows a fierce tension between the buying and selling sides.

The Spinning Top will not show you the trend. They indicate the price is in equilibrium, so you shouldn’t make a trade when meeting a Spinning Top candlestick.

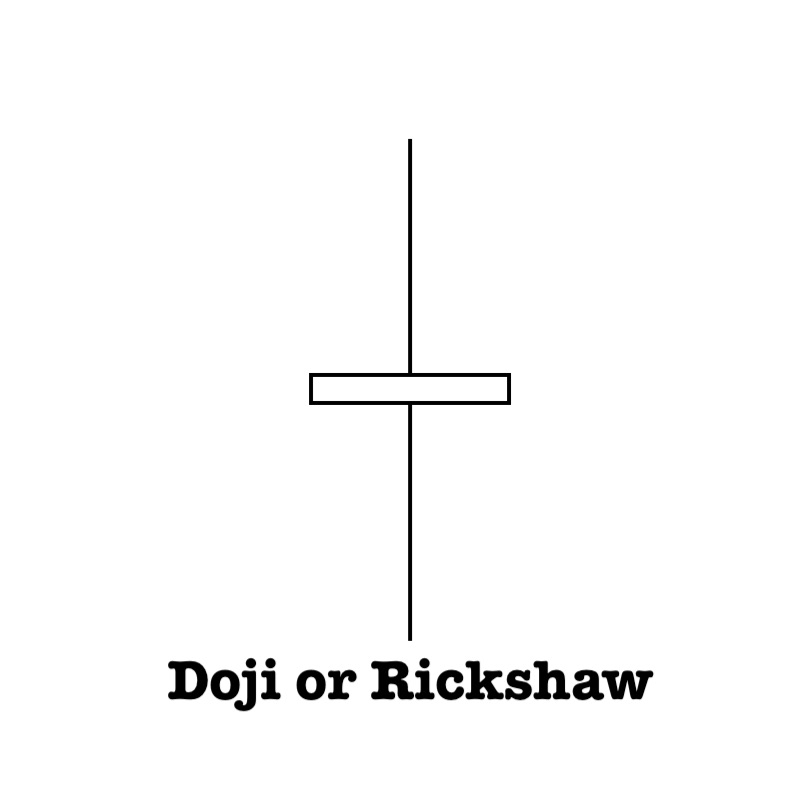

Doji or Rickshaw

Doji or Rickshaw is a candle that is used a lot in Japanese candlestick patterns. Usually, it appears as a support signal for the next candles to predict a reversal.

They are characterized by equal opening and closing prices. Its tail can be arbitrarily short or long, but the body is such as a horizontal line. It is also called a cross or plus candlestick.

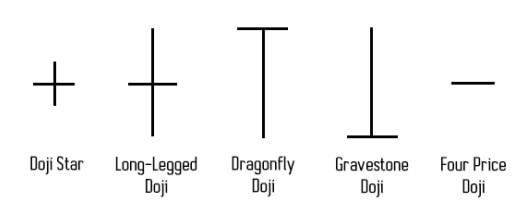

Variants of Doji (Rickshaw) candlestick like:

- Doji Star

- Long-Legged Doji

- Dragonfly Doji

- Gravestone Doji

- Four Price Doji

Those Doji are often found in popular Japanese candlestick patterns. However, if standing alone, they do not show anything. More indicator signals and patterns are needed to determine what the Doji represents.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

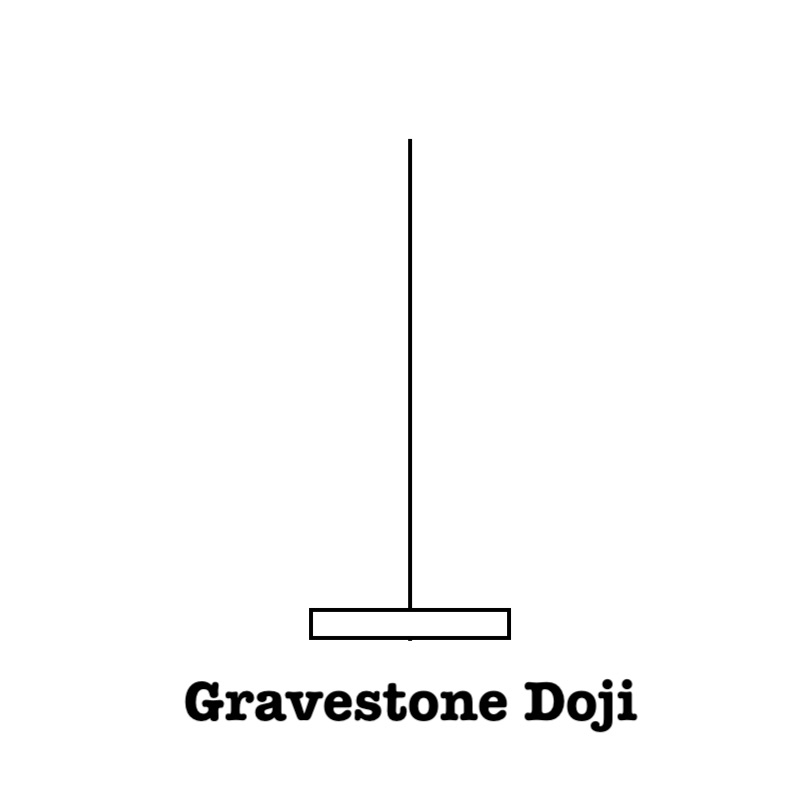

Gravestone Doji

The Gravestone Doji is a reversal candlestick pattern shaped like an inverted “T”. They are meant to appear on the momentum of an uptrend. The opening price and closing prices are equal.

The opening and the end of the session were both the troughs of the session. This opens up an opportunity for a strong reversal, with a high probability of a bearish reversal.

The longer the candlestick’s tail, the better, shows that the market is tilted to one side. Combine with a few indicators such as MACD, Oscillator, Stochastic, Support, and Resistance to open a position more accurately.

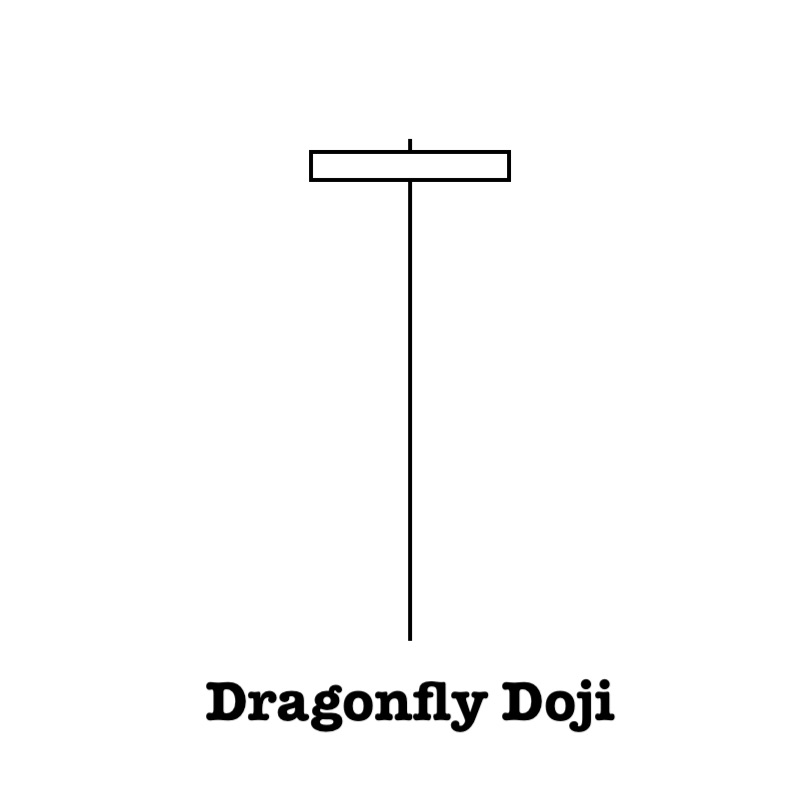

Dragonfly Doji

The Dragonfly Doji provides a nice bullish reversal signal. It makes a lot of sense with a “T” shape when it happens in a downtrend. It’s usually a reversal point. It has the same Gravestone Doji with a sharp body and long tail, but this time the real body is at the top.

The opening and closing prices are almost the same positions at the top, indicating that the pulling force is still inclined to one side. The market is being humbled on the buy-side. The total number of sales transactions has been reduced significantly.

This is a good time for both Forex and Fixed Time Trade traders. It would be best to buy or make a UP trade for a short time to achieve high efficiency.

This candlestick pattern also supports other indicators and patterns, increasing the reliability of the predictability.

![]() English

English ![]() हिन्दी

हिन्दी ![]() Indonesia

Indonesia ![]() Tiếng Việt

Tiếng Việt ![]() العربية

العربية

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.