Three Wyckoff Laws

The Wyckoff forex strategy focuses on the basic idea of having a clear knowledge of Wyckoff’s law and price cycles:

- Supply and Demand

- Cause and Effect

- Law of Effort

Supply and Demand

The Law of Supply and Demand is the first fundamental law of the Wyckoff method, which states that the price of a trading asset will change due to changes in supply and demand.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Take a look at Supply and demand equation:

- Demand exceeds supply means the price will increase.

- Supply exceeds demand means the price will decrease.

- Demand and supply are the same means there will be no change in the price.

But it is often difficult for traders to find the same supply and demand zones. Traders often use block, volume, and price action candles to find reliable supply and demand zones.

Cause and Effect

The Cause and effect law holds that trends have two main stages: accumulation and distribution.

The accumulation phase follows solid economic events as long positions are pushed up, preparing to take the price up. On the contrary, the distribution phase indicates the presence of sellers in the market during a downtrend.

Effort vs Result

When price action and volume show up moving in the same direction, it’s a reliable trend. Conversely, if they move in the opposite direction, then it could indicate a trend reversal.

The Effort vs Result law argues that the price of a trading instrument changes with a change in volume.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

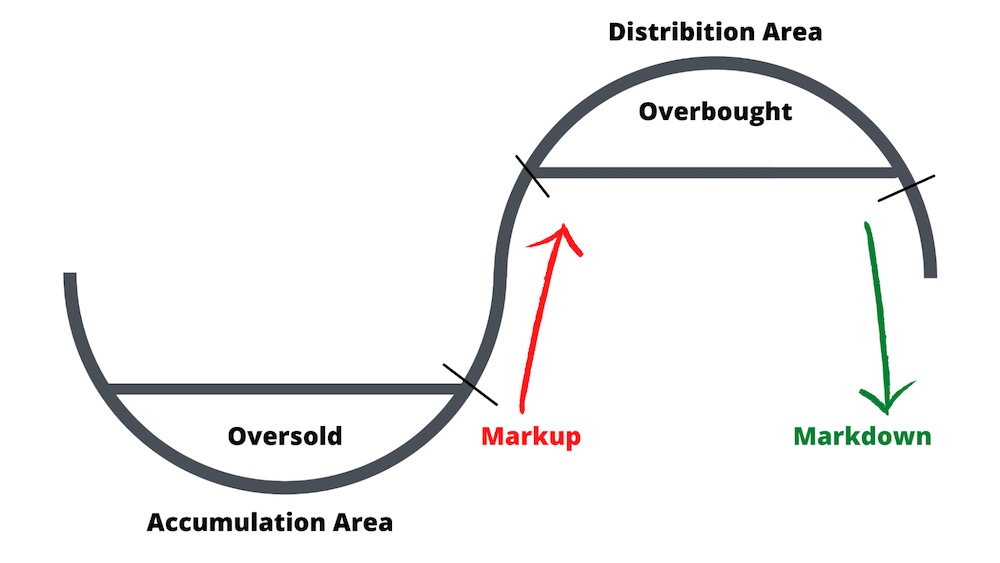

Wyckoff Price Cycle

According to the Wyckoff trading strategy, traders project the price direction of an instrument from supply and demand analysis, volume, and price action data.

The Wyckoff price cycle defines the accumulation and distribution in the price chart. Any buy trade from the markup zone has a higher success rate. Conversely, the markdown level comes from the end of the distribution phase, where taking sell trades have higher success rates.

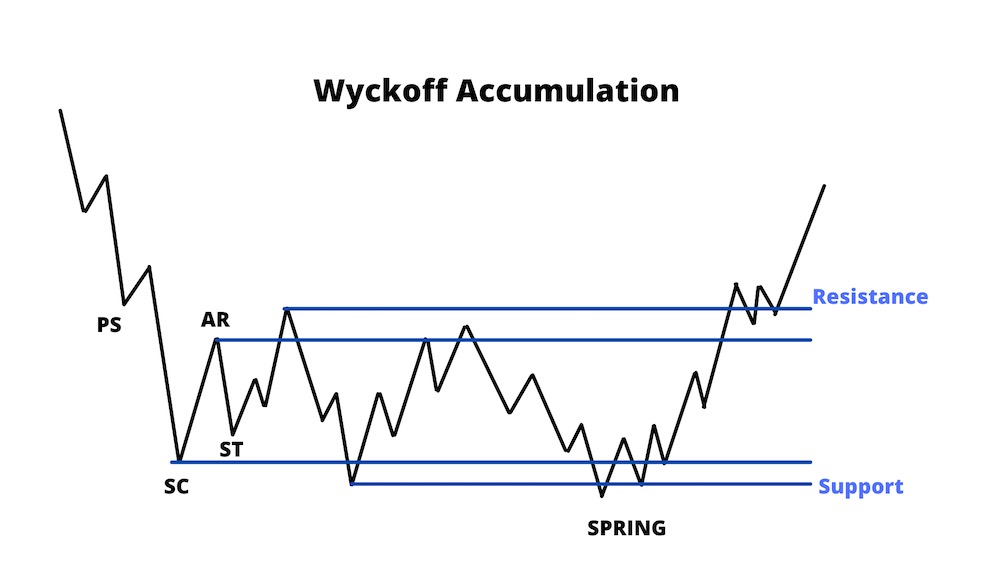

Wyckoff Accumulation Stage

In this section, we will see what happens within the Wyckoff accumulation phase.

First, the price fluctuates within a limited momentum after strong selling pressure. This shows buying by traders with big pockets and eliminates retail traders hoping to accumulate more profits.

According to the Wyckoff trading strategy, there are six stages of market accumulation, as shown in the image below:

Preliminary Support (PS)

The PS Phase usually occurs after a strong downtrend, where investors can see higher volume and wider spread. It indicates that the selling pressure is gradually ending with excessive volatility.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Selling Climax (SC)

During this period, the price will begin to decline with an extremely chaotic sell-off. After that, the price will go up in the shortage of supply. Investors can spot it by looking for a long bullish candle for a more accurate identification.

The Automatic Rally (AR)

After the price recovers in a sell-off session, the price will show that short-term sellers are still holding positions. Therefore, it is a barrier for buyers.

Secondary Test (ST)

After adjusting a few times, the price will gradually decrease again and the selling volume will be more stable.

The Spring (TS)

TS is the last selling pressure before the price rebounds. Retail traders might consider this a strong trend continuation at this point. After that, the price can rise again with a swing failure pattern.

Accumulation Schematic (AS)

This is the final phase of Wyckoff Accumulation where the price will break out of the range with strong buying pressure and confirm the breakout uptrend.

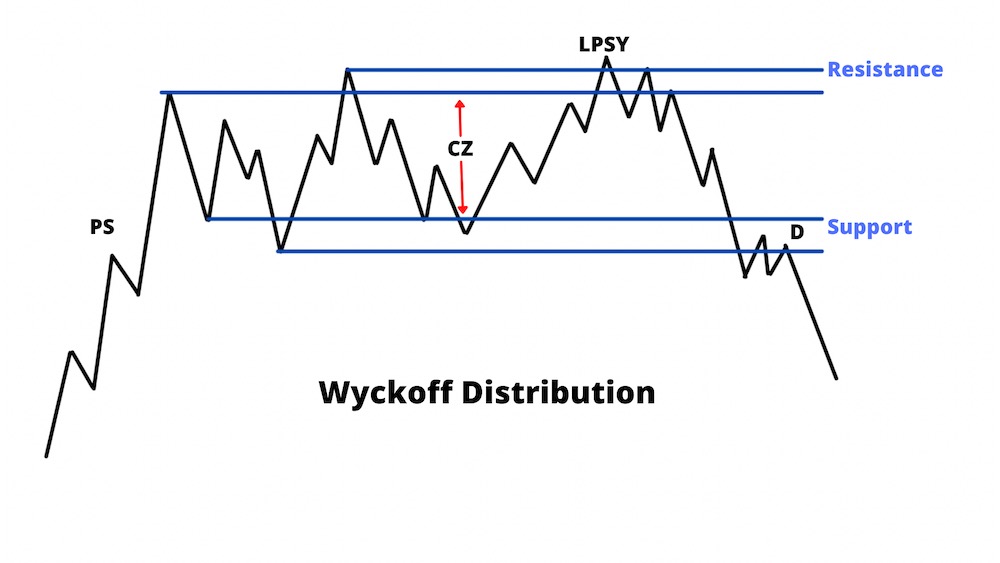

Wyckoff Distribution Stage (WDS)

WDS is the opposite version of Wyckoff accumulation, where a trend reversal from bullish to bearish occurs. There are four steps, as shown in the image below:

Preliminary Supply (PS)

It rises quickly after a strong rally when buying volume is strong and spreads are wide.

Consolidation Zone (CZ)

In this stage, the price fluctuation within the stable range of volume and spread.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Last Point of Supply (LPSY)

After a period of stabilization, the price will rise again with greater trading volume. Therefore, we can consider this as a continuation of the trend, but the price will reverse immediately after creating a new resistance level.

Distribution Marks (DM)

During this step, the price will form a bearish breakout out of the range, indicating a downtrend.

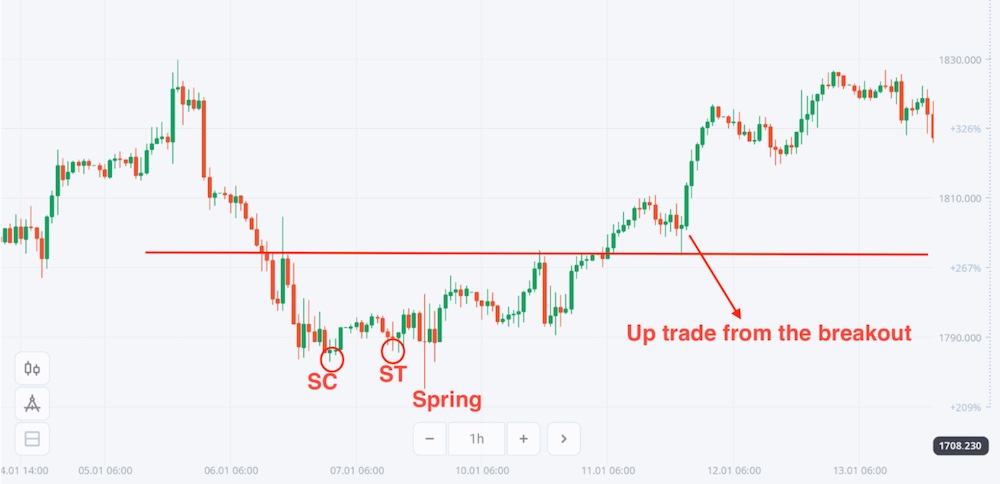

Price Action Trading Approach in Wyckoff Method

Once the market direction is established from the Wyckoff trading strategy, we can use price action to open buy/sell positions.

Aggressive Entry

As a first step, investors should find three Wyckoff accumulation positions. When the TS phase ends, the price can extend the uptrend for a long time. Traders should now turn to price action to find potential entry levels.

Conservative Entry

The cautious approach is to wait for the confirmation of the trend change and by finding a steady price above the TS level. The main purpose is to find the entry point in a strong uptrend, when a minor downside correction is possible. Instead of buying from TS, traders can wait for a bearish correction and open a trade from the short-term support level.

Conclusion

The Wyckoff trading method came into the world 100 years ago but still endures in the market as a profitable trading strategy. Moreover, traders can combine this theory with price action to generate profitable trading signals.

Price action is an important tool for financial market analysis that allows traders to read the market like a book 📚

Besides price action, traders can combine the Wyckoff method with other technical analysis tools like MA, MACD, RSI, etc. Go through the Traderrr Blog, where the detailed use of popular technical analysis tools is available.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

General Risk Notification: Transactions offered by Olymp Trade can be executed only by fully competent adults. Transactions with financial instruments offered on Olymp Trade involve substantial risk and trading may be very risky. If you make Transactions with the financial instruments offered on Olymp Trade, you might incur substantial losses or even lose everything in your Account. Before you decide to start Transactions with the financial instruments offered on Olymp Trade, you must review the Service Agreement and Risk Disclosure Information. Olymp Trade is operated by Saledo Global LLC; Registration number: 227 LLC 2019; Registered Office Address: First Floor, First St. Vincent Bank Ltd Building, P. O Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.