Forex or FTT trading is an undeniably profitable business. But it is not easy, the level of success in your trading work depends on many factors. And certainly among them, the element of analysis and prediction is the main key to success in any type of trading. This article shares 10 simple techniques that can help you identify the best entry points.

Technical Analysis Patterns

Future predictions are primarily based on observing the price performance of a trading instrument on a chart and opening a trade based on that observation. This approach thrived in the 20th century, it offers a multitude of patterns so that all traders can find patterns that fit their trading strategy.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Applying this technique is very simple. Basically, you just need to find the pattern that is appearing on the chart, it’s like the past repeats itself. Since it has a high probability of going like the past, you will now detect when to open a trade in the corresponding direction and wait to close it with a profit.

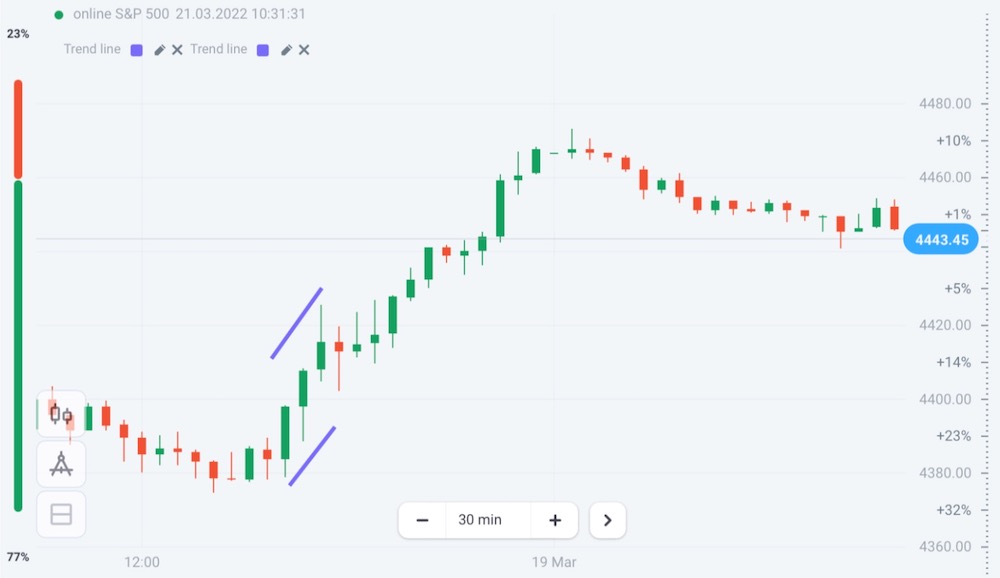

Example below: On the 30-minute S&P 500 chart below, we can see a series of three green candlesticks. Such chart formations are usually preceded by a strong uptrend. Therefore, when seeing this pattern, traders will open a buy trade once it is completed, remembering to set Stop Loss at the low of the lower candle.

There are many patterns and there will always be some that you can observe on the price chart at any given time. All you have to do is study them. Traderrr.com is a collection of the best trading knowledge to help you prepare for a successful trade.

As a result, you will have a solid base of technical analysis patterns that underpin ready-to-go trading strategies.

Trading on Economic News

Economic news can include any major corporate announcements, quarterly corporate earnings reports, CEO changes, monetary policy reports, and banks’ interest rate press conferences. countries, employment data, inflation dynamics, global oil consumption, production forecasts, and more.

Almost every day of the week throughout the year has news to trade. Insights on the Olymp Trade Blog will help you find this news, see which assets it refers to and open trades in the respective direction.

Trading on Corporate Earnings Reports

We have covered options trading on corporate earnings reports as part of our basic approach to trading economic news. However, income statement trading is so popular that it deserves a separate explanation as to why it’s so good.

It is useful because you can spend two “empty” months researching the stocks you want to trade. Then, during the reporting month, you make trades on all the stocks together.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Third, you will not miss the Earning Season because the Olymp Trade platform will notify you in advance. In addition, it will continue to notify you which reports appear in the respective week and suggest tips for opening trades on them. Plus, you can enhance your knowledge of Earnings Season with the Help Center section on the subject.

Finally, it’s not uncommon to see really big price swings on reports. As a result, earnings reports are likely to provide good profit opportunities.

For example, the long red candlestick on the chart below is what happened to Meta (Facebook) stock price after it reported earnings in February 2022.

Price Action

For example, the NZD/USD chart below shows a slight uptrend. It continues to form an uptrend with the indicated resistance line. After that, it confidently broke and the price continued to establish itself at higher fundamental levels. Therefore, when traders see this resistance line broken, it would be a good time to open a buy trade.

Fibonacci Methods

The Olymp Trade platform offers two Fibonacci indicators, the Fibonacci Level and the Fibonacci Fan. They are accessible through the Indicators menu.

As such, they can be effectively used to identify market entry signals.

Oscillators

Oscillator is a technical analysis tool used to see the trend energy at a certain point and check if the price is in the overbought or oversold zone. The latter is what points to a possible trend reversal.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

On the Olymp Trade platform, you can access the oscillators through the Indicators menu. This section lists all the most popular oscillators including the RSI, MACD and the Awesome Oscillator.

If you look at the 1-hour chart of EUR/GBP, you will see that the lowest point of the price is 0.8380 which corresponds to the point where the purple line of the RSI drops below 30. That is the oversold zone.

When the RSI crosses that level from the bottom up, it will be a sign that a new uptrend is forming and it’s time to open a buy trade. This is how useful an oscillator is.

Countertrend Strategies and Trading Psychology

This approach is based on the logic that the market reacts quickly to any major pessimistic news published. Whether such a release is later confirmed to be a real economic or geopolitical threat, it does not matter. Markets are made by people, and people have emotions. As a result, they often react emotionally even to something that could in fact be a negative and exaggerated personal opinion or one of many possible outcomes.

For example, a threat to current global oil production could push up the price of Brent oil. Therefore, a security incident at the ARAMCO site in Saudi Arabia or a military escalation in the Middle East involving oil-producing countries such as the UAE or Iraq could be an oil trading scenario.

Alternatively, any major geopolitical tensions announced by world leaders could also be news to trade. In 2018, at a time of economic confrontation between the US and China, the media regularly shared alarming quotes from the leaders of the two countries and trade observers.

Finally, in 2020, when news of the spread, impact and consequences of Covid-19 appeared in the media, the stock market ended up losing up to 30% of its value. Therefore, if you are trading in the panic market, it is the right time to do so. In the future, any such news is a good candidate for this type of trading.

Moving Averages

The Simple Moving Average, or SMA, is one of the most effective and easy to use trend indicators.

One of the simplest ways to use it is to see if the price of a trading instrument crosses the Up or Down SMA.

If the price crosses the SMA Up, it is a signal to open an Up trade.

If the price crosses the Down SMA, it is a signal to open a Down trade.

For example, on the Litecoin chart below, the price is already below the SMA set at 50 periods. After being there for a while, it confidently crossed the SMA. For many traders, that means opening an Up trade after the up trade.

Trading with Olymp Trade’s Signals and Analytics

These Expert Analytical Reviews provide price forecasts for various trading instruments, which are effective for quick and well-founded trading decisions.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Also, you may find useful information on the Olymp Trade platform about advisers and trading signals. Both can be effective technical tools to improve the outcomes of your trading process.

Personal Consultation

With Olymp Trade, traders can use the help of a personal trading consultant to reach higher trading levels quicker. This is an option that is available with different regularity on both the Advanced and Expert statuses.

Advanced traders can have one personal consultation a month, Expert traders can have four of them.

In both cases, these consultations are scheduled through Olymp Trade’s support department.

This tool can help traders form a customized learning process that takes them to their required trading levels faster. Also, they get to see real-market examples of trading and risk-management decisions made by an Olymp Trade expert.

Discover and Combine

This list doesn’t contain all the possible trading approaches that you can apply with Olymp Trade. Rather, it shows you various directions you can follow to discover the ways that best suit your trading objectives.

Olymp Trade strives to bring you the tools you need. You can check them out at the Help Center. Also, learn what you receive as a benefit of each available status.