If you already know about the Martingale strategy, is it the worst strategy in financial trading? Once you get into the financial markets, it’s hard to of cutting your losses. You can only create one suitable way to protect your capital account instead cut the losses continuously. One of the wise, but equally bad, ways is the Martingale.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

What is the Martingale?

For those who do not know, Martingale is known as the dumbest strategy in trading. Used in Fixed Time Trade or Forex trading, in short, you have to bet money multiple times after every loss. Of course, until you win, you will get your capital and profit back.

The thinking of Martingale players is simple: the chance is 50% for trade, every next bet will double the previous bet if they lose. They believe that the probability of losing consecutively is very low, the first losing rate is 50%, the second losing rate is 25%, then the third time is 12.5%, … continued lower and lower. That means your chance of winning is higher.

Is martingale reasonable?

Trader deeply thinking about everything

Nothing exists without effort. All types of money wagering need a lot of brainpower to get the best return. In terms of probability, analysis, Martingale is quite beneficial. You will probably also see benefits.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Psychologically, if you have a strong mentality, decide from the outset that losing doesn’t affect your mentality then you should play. Surely after a few rounds of play, you will reap profits.

But if your trading psychology is not good, the losing will affect every single turn of your trade, you need to stop but you don’t. Or you are a player with a small amount of capital, so you can’t play Martingale, because you will be affected a lot when your capital gradually reaches 0.

Manage your capital properly

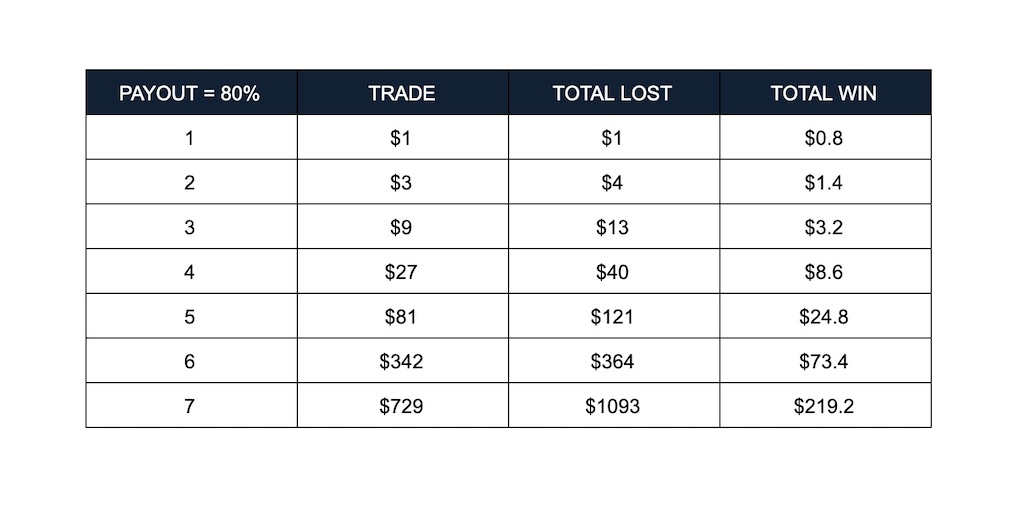

As mentioned, you need to have a fair amount of capital to play at least 10 consecutive losing bets. Avoid running out of money when you just make a few transactions. Sometimes spending a huge amount of money just to get less than 1/5 of the money spent. But it will guarantee a 90% chance of winning, it should be done. Just make a profit.

Martingale is wrong?

In data analysis, when using statistical probability, there is never 100%. Tossing a coin to get the face down 10 times in turn has the probability of 1/1024. If you are unlucky, you will lose all your capital. So are they worth trading?

In my opinion, it’s worth it. The reason is simply that you believe in your own decision. You use strategies, indicators, candlestick patterns to increase your own analytical abilities with the aim of winning in trading. Losing is completely unpredictable and you have no intention of losing continuously.

Martingale style is just a way to help you maintain your ability to regain your losses, in case your capital is very large.

Applying Martingale to Fixed Time Trade (FTT)

No stuffing

Absolutely not stuffing orders while trading. Because you will not be able to find a stop on continuous entry. Suppose among progressive stuffed orders, as long as the last one loses, you are still in the loss.

Register Olymp Trade & Get Free $10,000 Get $10,000 free for newbies

Psychologically stable

Even if you lose continuously, you should not be discouraged. Stick to the Martingale plan until you win.

Choose your stop

If your capital is not suitable for following the Martingale strategy, you should choose your stop. To play safe, you should choose the maximum number of consecutive losses allowed each time you play Martingale.

If this time loses, there will be another time. Don’t be too greedy, even if you see the market, there is a reason for you to lose so constantly, you need to calm down.

Apply indicators, models, strategies

The more methods that apply at a time, the greater the advantage. Sharpen your skills to see the key factors in data. To make better decisions that make it easier for you to profit.

The common point of these methods and strategies is to capture the moment of price reversal. Once it’s easy to spot the signs of reversal, it will be difficult to lose your trade.

Limit transactions per day

You may love creating short and long positions depending on your preference. But it is best to limit the number of trades per day. For example, one each morning – noon – afternoon. Following that, you have more time to research the news, the price, and the most suitable asset. In addition, it also helps you create habits, prolong trading time, avoid high emotions that cause you to fill orders.